As digital assets grow more popular, governments and agencies are actively developing regulations to bring greater structure to the area. The IRS is increasingly focusing on how taxpayers, both individuals and businesses, are reporting digital asset activity.

Digital assets refer to decentralized digital representations of value utilizing blockchain technology. Examples of digital assets include cryptocurrencies like Ethereum and Bitcoin, stablecoins like USDC, and non-fungible tokens (NFTs). Taxpayers can engage in a variety of transactions with digital assets, including trading (buying or selling), paying for services, making purchases, staking (supporting the blockchain), or derivative trading (options or futures).

Digital asset users generally have two options for storing their assets: a self-custodial digital wallet like Metamask or Rainbow or a centralized exchange like Coinbase or Kraken. The self-custody wallet options give the holder control and domain over their assets. Conversely, third parties manage exchanges, allowing users to access and make decisions with their assets, but the exchange generally retains ownership of the assets. Besides non-custodial wallets and centralized exchanges, there are a variety of decentralized platforms available that taxpayers can use to transact with their assets.

IRS Expands Digital Asset Question to More Forms

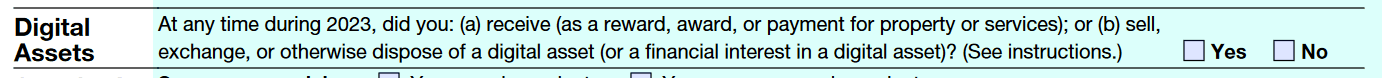

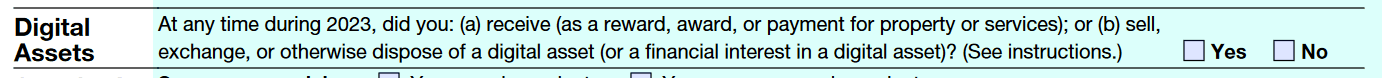

The IRS expanded digital asset questions to the 2023 versions of many tax forms to reflect the service’s increased focus on reminding all taxpayers that income from digital assets is taxable. In 2022, digital asset questions appeared on Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors, and Form 1040-NR, U.S. Nonresident Alien Income Tax Return. The wording for the 2023 Form 1040 is modified slightly from 2022 to remove the term “gift” from part b. It now reads:

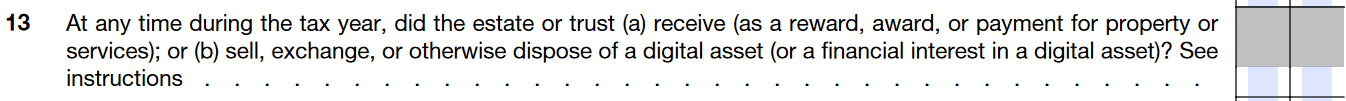

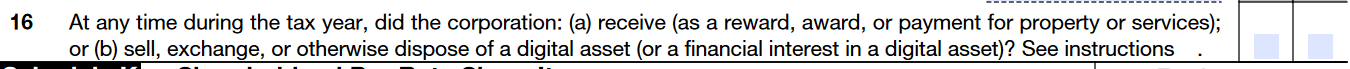

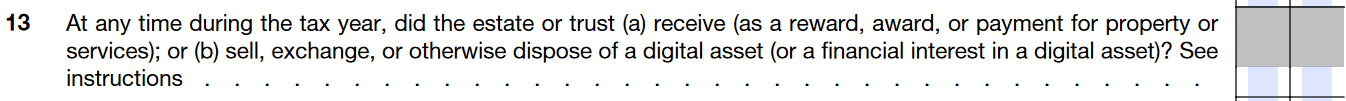

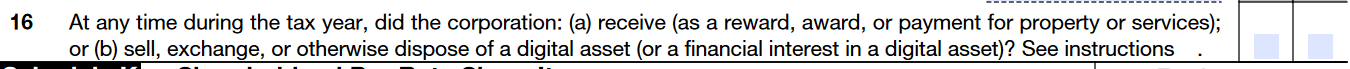

For 2023, a similar question appears for estates and trusts, partnerships, corporations, and S corporations, as follows.

Form 1041, U.S. Income Tax Return for Estates and Trusts

Form 1065, U.S. Return of Partnership Income

Form 1120, U.S. Corporation Income Tax Return

Form 1120-S, U.S. Income Tax Return for an S Corporation

Taxpayers should answer “yes” if they sold, exchanged, transferred, or gifted digital assets. They may answer “no” if their activities were limited to the following.

- Held digital assets in their own wallet or account

- Transferred digital assets between their own wallets or accounts

- Purchased digital assets using real currency

- Engaged in a combination of the aforementioned activities

Hiatus on Businesses Reporting Certain Digital Asset Transactions Until IRS Issues Regulations

The Infrastructure Investment and Jobs Act (IIJA) amended IRC §6050I to add digital assets to the list of what constitutes “cash” when determining whether a taxpayer must file Form 8300, Report of Cash Payments over $10,000 Received in a Trade or Business. Taxpayers who receive cash in excess of $10,000 in one transaction (or two or more related transactions) in the course of their trade or business must report the receipt of cash on Form 8300. Additionally, taxpayers required to file Form 8300 must also produce an annual written statement to each payer listed on the Form 8300. The new rules from IIJA apply to returns and statements filed after December 31, 2023.

The IRS and the Treasury Department intend to issue regulations to specifically address the situation in which a person subject to the Form 8300 rules receives digital assets or digital assets and other cash in excess of $10,000. Until those regulations are published, those taxpayers are not required to include digital assets when determining the $10,000 value.

Expanding Broker Requirements on Digital Assets

In August 2023, the IRS released proposed regulations regarding brokers and reporting requirements for the sale and exchange of digital assets on their platforms.

Taxpayers who engage in digital asset transactions are required to report their taxable income, gains, and losses on their income tax returns. Generally, the gain or loss from the disposal of a digital asset is reported similarly to the sale of stock. To appropriately calculate gains and losses, taxpayers need to track the cost basis of their assets. Currently, digital asset brokers are not required to send tax forms to users who buy or sell cryptocurrency on their platforms as is required for a traditional securities broker. Taxpayers must calculate their gains and losses independently, which can be expensive and challenging.

Who Needs to Report

The proposed regulations would require brokers of digital assets to report information regarding sales and exchanges on their platform to users. The regulations broaden the definition of a broker to include “any person who, for consideration, is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person”. Examples listed of brokers include online brokers, digital asset trading platform operators, and digital asset payment processors.

The broker regulations do not apply to merchants who accept digital assets as a form of payment for goods or services, those who engage in the business of providing proof-of-work or proof-of-stake services, and businesses that sell hardware or license software for which the only purpose is so users can access digital wallets.

What Needs to be Reported

Brokers subject to these regulations would need to report similar information already required to be reported on a Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, such as the customer’s name, digital asset sold, date and time of the transactions, etc.

The requirement for brokers to obtain users’ personal information may be challenging for some decentralized platforms, as many platforms currently only require users to link their digital wallets.

Additionally, brokers would be required to report the gross proceeds from the sale or exchange of virtual assets. The regulations define a sale as any disposition of a digital asset for cash, a stored-value card, another digital asset, or the receipt of a digital asset as settlement for a forward contract, option, futures contract, or any similar instrument.

Gain is calculated as the amount realized over the basis of the digital asset. The amount realized includes the value of cash, property, or services rendered in exchange for the disposition of the asset.

In some cases, brokers would also need to supply basis information to customers. The regulations provide that the adjusted basis of digital assets is the cost at the date and time the asset is exchanged, including any transaction costs. The obligation to report basis information would solely extend to brokers offering hosted wallet services, with non-custodial brokers not currently mandated to comply with this requirement.

The method for identifying the cost basis of disposed digital assets is also addressed. For assets held in unhosted wallets, the taxpayer can use specific identification to determine the basis and holding period of the units as long as adequate records are kept for all units in a wallet or account. Taxpayers can also provide instructions to brokers specifying the units they are going to sell prior to the sale to ensure the broker appropriately reports the basis. If a taxpayer does not use specific identification, the default method is first-in, first-out (FIFO).

A new tax form, Form 1099-DA, would be introduced for brokers to report the required information to taxpayers. The IRS has not yet released a draft of the form or provided any instructions on how to complete it.

When the Proposed Regulations Take Effect

These regulations would need to be filed by brokers in 2026 for transactions occurring on or after January 1, 2025. The basis reporting requirement would be further delayed applying for transactions on or after January 1, 2026.

Why the Proposed Regulations are Being Introduced

The IRS indicated that these regulations intend to assist taxpayers and tax professionals by mitigating confusion surrounding the reporting of digital assets while also enhancing the visibility of income generated from digital asset transactions. The agency expressed that one of the objectives is to increase compliance with digital asset transactions and help close the tax gap.

Thoughts for Tax Professionals

Tax professionals should keep their clients who engage in digital asset transactions informed about the proposed regulations and any subsequent updates to the rules so they have adequate time to make decisions regarding their assets. Additionally, the new proposed regulations may raise some challenges for digital asset cost basis tracking for taxpayers who transact across a variety of platforms and wallets.

The IRS is actively developing frameworks to streamline reporting processes and enhance compliance regarding digital assets. The proposed regulations signify a significant step forward by not only expanding the definition of brokers and mandating reporting requirements but also providing helpful guidance to taxpayers regarding digital asset transactions.

By Kelly Golish, CPA

University of Illinois Tax School

By Ashley Akin, CPA

Sources

REG-122793-13: Gross Proceeds and Basis Reporting by Brokers and Determination of Amount Realized and Basis for Digital Asset Transactions (federalregister.gov)

IR-2023-153: Treasury and IRS issue proposed regulations on reporting by brokers for sales or exchanges of digital assets; new steps designed to end confusion, help taxpayers, aid high-income compliance work (irs.gov)

IR-2024-12: Treasury and IRS announce that businesses do not have to report certain transactions involving digital assets until regulations are issued (irs.gov)

Announcement 2024-4: Transitional guidance under section 6050l with respect to the reporting of information on the receipt of digital assets (irs.gov)

IR-2024-18: Taxpayers should continue to report all cryptocurrency, digital asset income (irs.gov)

Digital asset question added to more forms for 2023 tax returns (journalofaccountancy.com)