What Does “Like-Kind” Really Mean Anyway?

This question was recently raised in the University of Illinois Tax School Facebook Group and addressed in the September 29, 2022, agriculture update webinar entitled New Twists on Tax Strategies…

December 5th, 2022

For pass-through entities based in states other than New York and California, there is still time to reduce their S corporation shareholders’ and partners’ 2022 tax burdens through the PTE tax deduction. But the window of opportunity closes on December 31. This blog illustrates why it is essential to remind profitable pass-through entity clients to make their Illinois estimated tax payments.

As discussed in the 2022 University of Illinois Federal Tax Workbook, 28 other states have also implemented their own rules for pass-through entity (PTE) payments.

Illinois shareholders of S corporations and partners of entities taxed as partnerships can benefit from the PTE tax. By paying their share of state taxes, the S corporation or partnership pays an individual’s share of income at the entity level. As a result, the state tax is not subject to the $10,000 state and local tax (SALT) limit. Assuming that the shareholder/partner files a Schedule A, Itemized Deductions, with their Form 1040, the state tax they pay on their corporate or partnership income is no longer limited to $10,000. Because the entity pays the individual’s state tax for them, the ordinary business income reportable to the IRS is decreased. On the Illinois return, this deduction is added back using Schedule M, Other Additions and Subtractions for Individuals, line 2, so taxpayers report it in step 2, line 3, on the taxpayer’s Form IL-1040. The amount relating to the income tax is included as a credit in step 8, line 28.

This combination of actions accomplishes a significant result. For all intents and purposes, the entity pays the income tax on behalf of the shareholder or the partner.

An example can illustrate how it is still worthwhile for the entity to make on or before December 15 the payment for the entire year, even though three of the payments are late and the entity incurs penalties. Let’s assume we have an S corporation client that operates solely in Illinois and has only one shareholder, an individual under age 65 who uses single filing status. This S corporation is projected to have an ordinary business income of $100,000 before accounting for any state income deduction. Besides this ordinary income from Schedule K-1 (Form 1120-S), the individual shareholder’s only income is reported on a Form W-2, showing $250,000 in box 1. For simplicity’s sake, let’s assume there is no net operating loss carryforward and no state tax on the prior year’s return. We also assume that the shareholder makes only one payment on December 15, 2022, for 90% of the actual Illinois replacement and PTE tax due, or $5,805 (90% × ($100,000 × 1.5% replacement tax + $100,000 × 4.95% PTE tax)).

If the shareholder wishes to take advantage of the PTE tax benefits, the entity and the sole shareholder report the following.

The following table shows that the sole shareholder receives a federal tax benefit of $1,626 ($86,102 – $84,476).

| Without PTE Election | With PTE Election | |

| Income tax | $85,652 | $84,026 |

| Medicare tax on wages | 450 | 450 |

| Total tax | $86,102 | $84,476 |

Next, the federal tax benefit should be compared with the expected state penalties, given that the S corporation does not make a tax payment on behalf of the shareholder until December 15, 2022.

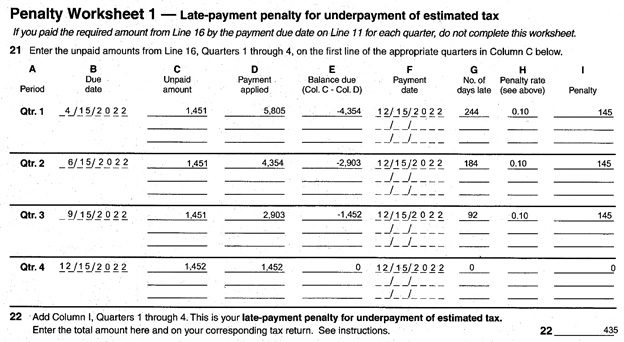

Under the rules effective in Illinois for 2022, the S corporation should have made four payments totaling 90% of the S corporation’s state tax liability. If only one payment is made on the last due date, December 15, Penalty Worksheet 1, Form IL-2220, shows the entity-level penalty of $435, as shown next.

Thus, the federal tax savings exceed the state tax penalty by $1,191 ($1,616 – $435).

This favorable result begs the question of whether the sole shareholder should expect penalties associated with their individual income tax filings. The answer to this question depends on whether the shareholder has made estimated tax payments individually. If they made estimated state tax payments in anticipation of the $100,000 ordinary income appearing on their Schedule K-1, their Illinois tax return likely shows no penalty, regardless of whether the S corporation paid PTE tax on their behalf. Illinois only requires estimated payments if more than $1,000 of tax is due.

On the other hand, if the shareholder had only $10,000 of state tax withheld, with no estimates in addition to the PTE tax paid, the shareholder should expect an Illinois underpayment penalty of approximately $419 for 2022 because the PTE tax is treated as a payment on the last day of the year. When permissible, the use of the annualization method may reduce this penalty. This calculation reflects the conservative assumption that the shareholder receives no credit until the last day of the year. It would seem more realistic for the shareholder to receive credit for the PTE payment when the entity makes it. Indeed, some tax software shows this calculation, in some sense reflecting the requirement for the entity to pay the tax four times during the year, rather than just on the last day as the Illinois statute indicates. Tax practitioners may wish to advise their clients that the window of opportunity to use the PTE tax deduction for 2022 closes very soon.

Even though a pass-through entity may incur penalties for late payment of PTE tax, they will likely be better off paying the full year’s tax by December 15. The federal tax savings of $1,626 is still greater than the sum of the entity and shareholder penalties of $854. Of course, your results may vary. This relatively simple example illustrates the value of reminding clients by December 15 to make their fourth quarter state estimated tax payments.

| By John W. Richmann, EA, MBA Tax Materials Specialist, U of I Tax School  |

By Catherine Riddick, CPA, JD U of I Tax School Instructor  |

Sources

Pass-through entity tax (PTET). October 24, 2022. New York State Department of Taxation and Finance. [www.tax.ny.gov/bus/ptet/#partnership] Accessed on November 23, 2022.

IDOR Publication 129, Pass-through Entity Information. p. 8. (2022).

Illinois Income Tax Act §804(g)(2).

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.

Join 1,400 of your colleagues and get notified each time a new post is added.