Social Security and Medicare Update Webinar

Tuesday, June 24, 2025

1:00-3:00pm central

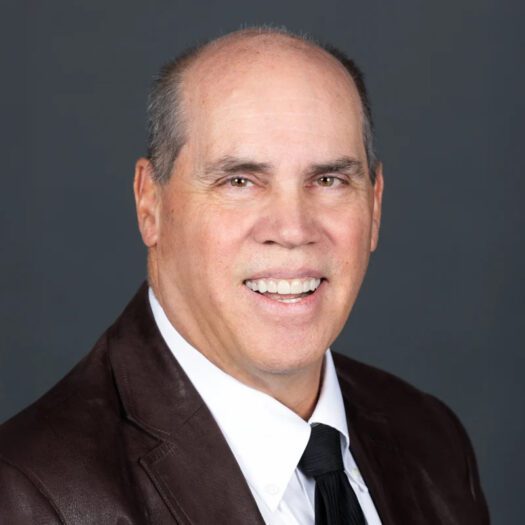

Join Michael Miranda as he addresses the benefits and rules of Social Security, Medicare and Medicaid. As baby boomers retire and the general population ages, tax and financial planners will find that clients may require assistance in addressing retirement, eldercare, and government entitlement program matters. He will also address any current updates to these government benefit programs.

Clients will be best served by consideration of planning techniques designed to maximize these special retirement and eldercare benefits.

2 CPE Credits