Style Guide

Introduction

Please look over the grammatical and stylistic conventions outlined in this guide and try to follow them as closely and consistently as possible.

Be sure to see the citation styles. Failure to adhere to these styles may result in the manuscript being returned. We recommend using Ctrl + F to search this style guide for the guidance you’re looking for.

If you have questions about style or word usage beyond what this style guide explains, you can always search or browse our online workbook archive.

Submission of Manuscripts

All manuscripts should be sent to us electronically, and all content should be authored using the Tax School Microsoft Word template. No paper manuscripts will be accepted.

When incorporating or adapting content from previous Tax School workbooks, please clearly indicate these sections in the Word file via comments.

When using content from previous workbooks, the material needs to be thoroughly reviewed with respect to required citations because our standards have changed over time. In addition, tax laws are subject to change, so content that was factually correct in a workbook chapter several years ago may not be factually correct today.

Additionally, all editing passes are done electronically within Microsoft Word, with tracked changes enabled. On-paper edits are not acceptable.

Reserved Right to Edit

The Tax School reserves the right to edit submitted content for accuracy, style, length, and comprehension, including expanding, redacting, and/or reorganizing where necessary, as well as proofreading for format, capitalization, punctuation, and spelling, in any manner Tax School deems suitable.

Avoiding Plagiarism

When adapting content from other sources, you need to make sure you are not inadvertently plagiarizing the material. Plagiarism is defined as using or closely imitating the language and thoughts of another author without authorization and/or the representation of another author’s work as your own without indicating due credit to that other author. To avoid plagiarism, you can use such strategies as changing sentence structure, switching from active to passive voice (or vice versa), using synonyms when possible, and always citing the source.1 An example showing plagiarism and acceptable paraphrasing follows.

Original source material:2 While in just about every situation a creditor must present its claim against a decedent’s estate within a short time-frame post-death, the rules governing the ability of the IRS to collect on an unpaid tax liability from a decedent’s estate are different.

Plagiarism: While in almost every situation a creditor must present its claim against a decedent’s estate shortly after death, the rules affecting the IRS’ ability to collect on an unpaid tax liability from a decedent’s estate are different.3

Even though a citation is provided, this is plagiarism because the writer only changed a few of the author’s words and did not put the author’s original words in quotation marks. While plagiarism could be avoided by treating this as a direct quote, Tax School style minimizes the use of direct quotes, preferring instead to adapt the material in question.

Acceptable paraphrasing: A creditor is usually required to submit a claim against an estate soon after the death of the decedent. These rules differ from the regulations that allow the IRS to obtain payment of unpaid taxes from an estate.4

This is acceptable because the sentence structure and wording is much different than the original. However, even though the paraphrasing is acceptable, a citation is still necessary.

For more strategies that can be used to avoid plagiarism, see https://integrity.mit.edu/handbook/academic-writing/avoiding-plagiarism-paraphrasing.

Material from IRS publications, the tax code, Treasury regulations, revenue procedures, and similar sources can also be used. Citations must be provided, either in the main text or in footnotes. An example of a citation (highlighted) within the main text follows.

IRC §1(h) does not contain a definition of “net capital gain.” Under IRC §1222(11), net capital gain is defined as “the excess of the net long-term capital gain for the taxable year over the net short-term capital loss for such year.”

References to CCH or other publications by private publishers are protected by copyright, whether or not they contain copyright notices. If parts of your manuscript are taken from private sources, you must furnish the Tax School with a “permission to use the material” letter from the source.

Tax School utilizes grammerly.com as part of our editorial vetting process, and submissions any potential plagiarism is flagged.

Using Footnotes

The use of footnotes is essential because it allows readers to verify material and find additional information. Footnotes should be used in the following circumstances:

- To cite the tax authority used in the author’s writing (such as tax code sections, regulations, or other IRS guidance or case law).

- To provide the reader with appropriate credit for other works upon which the author has relied or used in the authorship of the manuscript.

- To provide support for every substantive point or assertion made. This provides the reader with the source of the information and prevents the content from being perceived as opinion.

Preference should be given to citing those sources of information that constitute “substantial authority” where applicable. The list of items constituting substantial authority is taken from Treas. Reg. §1.6662-4(d)(3)(iii). The higher in the list a source is, the greater its authority, so ideally use a source with greater authority where possible.

Use of sources constituting substantial authority is preferred over citation of IRS form instructions, web pages, IRS News Releases, publications, or other sources (although these, and other sources, may be used if there are no other sources available for the assertion being made, or to provide clarification if another source is unclear).

- A footnote should be located at the end of the first sentence to which the citation applies, or immediately following a specific term or court case name within a sentence.

- If the very next instance requiring citation uses the exact same source, a footnote of “Ibid.” is used, even if the footnote falls on a subsequent page. Note: Ibid. should always be followed by a period.

- It is acceptable to use a footnote at the end of a paragraph if the entire paragraph is sourced to the same citation.

- If a citation pertains to an entire H1, H2, or H3 section of the text, the citation should be included at the end of the header.

- Ideally, definitions or explanatory text are presented in the main text rather than as footnotes, however explanatory footnotes are acceptable if appropriate and not overused throughout the chapter.

- Separate multiple citations within the same footnote with semicolons (even if only two citations), and don’t include the word “and.” The most important or the most relevant source should appear first. Thus, a citation of a Supreme Court decision precedes a reference to the appellate court decision.

- Content in examples is generally not cited, unless the example is taken largely from IRS Publications, Treasury Regulations, etc., in which case a footnote stating “Example taken from XXXX” or “Example adapted from XXXX” is placed at the end of the first sentence of the example.

- Footnote numbers fall outside punctuation.

Visual Elements

Header Hierarchy

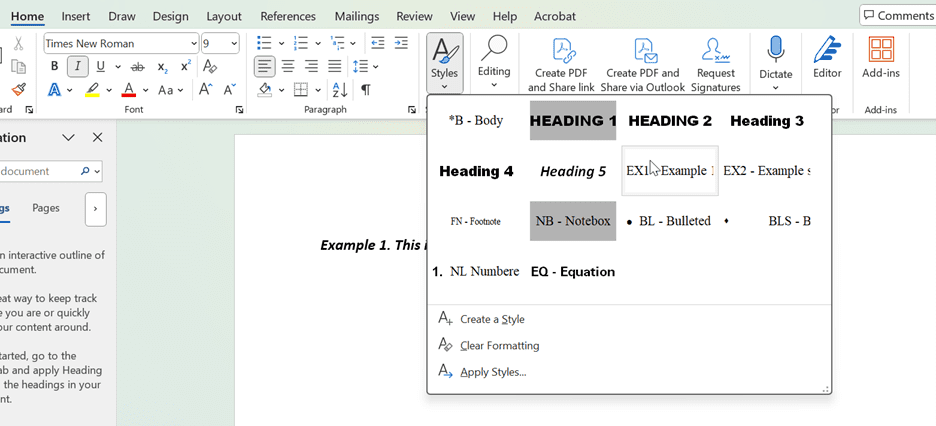

The following image displays the header hierarchy used in the workbook. Content has been removed to make all the headers fit on the same page.

Note/Caution/Observation Boxes

These are indented, shaded, bordered boxes that include practitioner notes, cautions, and observations. The preface word, usually “Note”, “Observation”, or “Caution,” should be styled in bold and end with a period. A single space follows the period, and the body of the text is not bold (except for an occasional word or phrase).

Authors should use the ‘Notebox’ style when writing in Word, which will apply proper indent and shading.

Use a Note Box when calling special attention to a matter or when directing the reference a past year/volume of the Federal Tax Workbook. Additionally, opinions or statements without authoritative support can be placed in a notebox or observation box.

Use a Caution Box when there’s a special consideration the reader should take, e.g. potential changes in legislation.

Use an Observation Box when offering an additional thought on a topic.

Practitioner Planning Tips

Authors should use the ‘Notebox’ style when writing in Word to denote a Practitioner Planning tip; there is not a special style for these tips.

In typeset version, these tips will be set apart from regular text with a light bulb icon and horizontal bars.

Use a Practitioner Planning Tip when there is an action a tax preparer should consider or a recommendation they could make to their clients.

Examples

Examples should be developed and used to illustrate calculations or assist in the learning of tax rules or concepts. The author should use examples, tables, completed forms, and checklists where appropriate. See the Tax School archive of prior year workbooks for previously used examples.

Examples are indented from the margin on both sides. The Example header is at the beginning of the first paragraph of the example, styled in bold, and includes a period. The body text of the examples is the same as the standard body text. Subsequent paragraphs of the same example simply have the same indent without any header; use the Ex2 formatting style in Word.

- Numbering. Examples are numbered consecutively beginning at the start of the chapter.

- Dollar amounts. Dollar amounts in examples should be whole dollar amounts only (round where necessary).

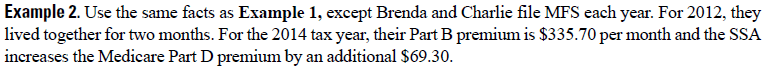

Inserting an Example

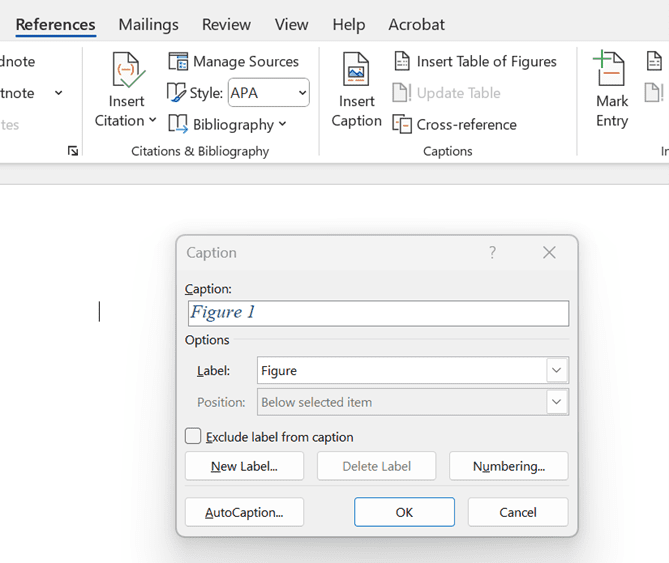

There are two steps to inserting an example: inserting the caption and formatting the caption. Below are some screenshots to walk through the process.

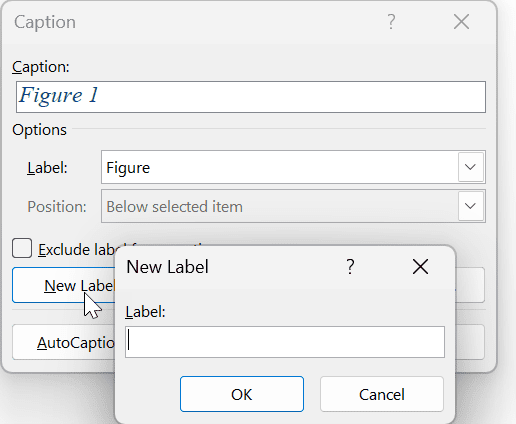

Within the Word template, go to References – insert caption. This is the default screen.

Sometimes “Example” is provided in the list of available captions.

If not, you will need to add a new label.

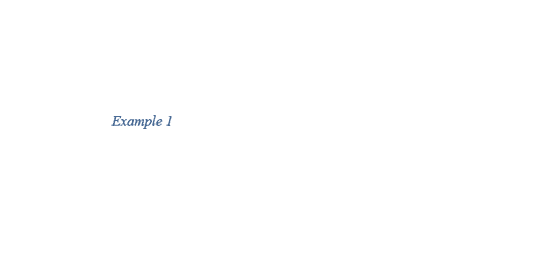

After typing in “Example” and selecting “Ok”, the example will appear in the Word document with an associated number and in italics.

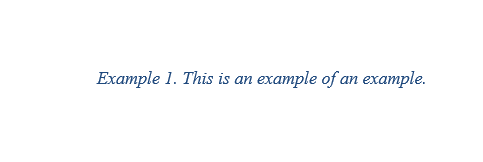

Continue to write the text of the example.

The next step is to form the Example. Place the curser ahead of the word “Example”. Go to Home – Styles – Example 1.

Highlight the “Example #.” and make it bold.

Cross-Referencing Examples

When using the same information as a prior example, the text should read “Use the same facts as Example 14.” or “Use the same facts as Example 14, except…” (note the references to the prior example number in bold). Whenever a numbered example is referred to subsequently in the text, it is bolded. When an example builds upon a previous example, only the most appropriate previous example is cross-referenced. Generally, this is the immediately previous example.References to previous examples should be inserted as cross references in Word rather than plain text so that renumbering does not have to be done manually if examples get added, removed, or reordered. To insert a cross reference in Word, go to References, cross-reference, select the appropriate reference type from the drop box (e.g. example), select “Only label & number” from “Insert reference to:” drop box.

Questions and Answers

Questions and answers are treated stylistically like the Examples (same font, size, punctuation, and characteristics).

- If there is only a single question and answer pair as part of an example or outside of an example, you simply use “Question.” and “Answer.” as the headers.

- A sequence of question and answer pairs within an example is numbered using the example number and an alphabetic sequence, e.g., Question 7A, Answer 7A, Question 7B, Answer 7B.

- A sequence of question and answer pairs in text not tied to a specific example are simply numbered Question A, Answer A, Question B, Answer B. Renumbering starts depending on the context of the section (no hard and fast rules).

IRS Forms and Schedules

Reprinted IRS forms and schedules are not given separate titles or headers when inserted in text, although it should be apparent from the lead-in text preceding the form which form number it is. The first time a form or schedule is referenced in text within a given chapter, it should be referred to by form number, a comma, and complete formal title in italics, e.g., Form 8379, Injured Spouse Allocation.

When partial forms are required, either crop the form to the approximate section you want shown or delineate on the form the section(s) to be included.

The easiest way to include an IRS form in the Word file is to:

- Download and fill in the PDF from the IRS website

- “Save As” a TIFF file

- Copy TIFF file into the Word file

Note: Internal Tax School staff should follow the usual method for saving forms on the shared drive so Dan can put them in the appropriate format.

- Numbers entered into IRS forms filled out by a taxpayer (e.g., 1040, schedules, 1065) should include a comma as a thousands separator, and no decimal period, cents, or dollar symbol. Example: 14,500

- Numbers entered into IRS forms provided to a taxpayer (e.g., W-2, 1099) should not include a comma as a thousands separator or a dollar sign, but should have a decimal and cents. Example: 14500.00

- Note: When including a form provided to a taxpayer, use Copy B (“For Recipient”).

- When filling out a form (e.g., to support the fact pattern of an example):

- Use mixed case for all names, addresses, etc.

- Redact the first six digits of a SSN or ITIN, placing asterisks in place of the digits. Example: ***_**_1234

- Do not redact other numbers such as FEIN

Tables

Tables can be created by either using Word’s built-in table function, or by embedding an Excel spreadsheet. Do not copy tables into the Word file as images or screen captures; we need to be able to edit the tables within Word. If using a table from a previous Workbook, identify the year to Dan as inline text.

Tables are not labeled/titled. Headings are centered above the columns, except for the first column, which is aligned flush left. Check for consistency in bolding, underlining, etc. within tables.

- Tables use the standard accounting convention of representing negative values by enclosing them in parentheses.

- The dollar sign, when used, should be to the left of the first amount in the column. In tables where all elements in a column (or section) are dollar amounts, the dollar sign is to also appear on total or subtotal lines. When columns are composed of a mixture of dollar amounts and other types of numbers (raw percentages, etc.) the dollar sign should appear on all lines when a dollar amount is used (exception: if all rows in a column except one or two have dollar amounts, and the others have percentages along with the percent symbol, this rule may be waived at the discretion of the editors).

- Numbers are decimal-aligned.

- When a line item is equal to $0.00, it is represented by a “0,” not a “-” or blank.

- Authors may request certain lines of tables to be made bold for emphasis; editors reserve the right to modify formatting as they see fit.

- Example tables should use whole dollar amounts only. Round as necessary.

- Text in tables should use sentence case (only the first word is capitalized).

- Footnotes within tables that are explanatory in nature (calculations, terms used, clarifiers, etc.) are lettered a, b, c, etc. and are included at the bottom of the table.

- Footnotes within tables that are citations get folded into the chapter-level footnote numbering sequence and fall at the bottom of the page.

Lists

For ordered lists, use the following hierarchy:

- Numbered

- Alphabetical

- Roman numeral

Non-ordered lists should be bulleted. If a bulleted list falls within another bulleted list, use a diamond-shaped bullet for the sub list.

It is acceptable to have a bulleted list within a numbered list.

Quotes and Excerpts

Content from external sources when quoted verbatim are treated differently, depending on the length of the quote/excerpt.

- Quoted text that is individual words or a sentence fragment can be included in normal text within double quotes.

- Quoted text that is a full sentence or longer should be set as an Excerpt, which is a separate paragraph(s), sans-serif italic, indented from both left and right margins.

- Ellipses (3 periods) can be used to indicate words have been omitted from the quoted material.

- All quoted content, whether in text or as standalone excerpts, must be cited.

If you choose to highlight a portion of the quoted material in a manner different from the original publication, e.g., bolding words or phrases, add “[Emphasis added]” either at the end of the quote/excerpt or immediately following the altered text, depending on formatting and visual clarity.

Style

Em and En Dashes

Em-dashes are used to separate clauses or terms/acronyms from their definitions, and have a space on either side.

En-dashes are used to separate ranges. They can also be used in text for minus signs.

Em- and en-dashes are inserted in a Word document through Insert > Symbol > More Symbols > Special Characters or through corresponding shortcut keys.

Slashes vs. Hyphens

There is a distinct difference between “shareholder-employee” and “shareholder/employee.” The former is someone who is both a shareholder AND an employee, whereas the latter is someone who is a shareholder OR an employee. Do not arbitrarily change one to the other. This also applies to stockholder-employee and other similar terms.

Bold for Emphasis

Use only bold for emphasis within text (excludes headers), not italics, not underlined and no combination of bold, italics and underlined. When a bold word, string of words, or a sentence is followed by punctuation or a footnote, the trailing object(s) should also be bold.

Write Out Dates in Text

The date 1/1/2001 should be written January 1, 2001; ordinal suffixes are not used unless referring to a generic timeframe, e.g., “the 15th of the month.” Rather than “the April 15th IRS deadline,” write it as “the April 15 IRS deadline.” Ordinal suffixes should never be superscripted. In footnotes, all months are abbreviated, followed by a period, with the exception of May, which is not followed by a period (Jan., Feb. Mar., Apr., May, Jun., Jul., Aug., Sep., Oct., Nov., Dec.).

Always include a comma after a date (unless it ends with a period due to end of sentence), e.g., “On January 1, 2001, the IRS published…”

Spell Out Numbers

All cardinal numbers less than 10 should be spelled out, not represented as a number, unless they are:

- Used at the beginning of a sentence;

- Used in addresses and court decisions;

- Used as a unit of measure, i.e. 2-year carryback, 5-unit apartment building, or 66-year-old man; or

- Used in fractions, percentages, sizes, equations, or calculations.

Cardinal numbers 10 or more should be spelled out only if used at the beginning of a sentence.

Ordinal numbers should generally be spelled regardless of the number (e.g., first, twenty-second). However, any references to court decisions should use Arabic ordinal numbers to identify the court or any part of the decision. These numbers should not appear in superscript (e.g., 9th Circuit Court).

Periods and Other Punctuation

When using punctuation marks with quotation marks, they should usually fall inside of the quotation marks. (i.e., “…before the end of the “exchange period.”).

Use the Oxford comma when writing lists in text (i.e., “…the flag was red, white, and blue.”).

Decimals, Not Fractions

Wherever possible, use decimals rather than fractions, e.g., 8.25% rather than 8¼%.

They/Their, not He/His or She/Her

Rather than attempting to equitably balance the use of masculine and feminine pronouns and possessives throughout the book, the Tax School is adopting the standard of using the singular “they” and “their” in regular text, rather than using “he,” “he/she,” “s/he,” or “he or she”. For example, the following sentence:

The corporation may not know what a specific shareholder paid for his stock if he purchased it from another shareholder.

should instead be written as:

The corporation may not know what a specific shareholder paid for their stock if they purchased it from another shareholder.

In examples, however, it is still appropriate to use gender-based possessives and pronouns.

Punctuation/Capitalization of Lists

- The sentence preceding a list of items that are each complete sentences never ends with a colon; it ends with a period or other ending punctuation.

- The sentence preceding a list of items with no punctuation never ends with a colon; it ends with a period.

- The lead-in preceding a list of items that together with the list would form a complete sentence always ends with a colon.

- Semicolons are used at the end of all list items when one or more items in the list already contain commas.

- Lists that in their entirety comprise a complete sentence should have a conjunction following the next to last list item. In items 3 and 4 above, the second-to-last list item has a conjunction such as “and” or “or” following the trailing comma or semicolon.

- List items always begin capitalized, even when they are continuing a sentence.

References to Workbooks

- Our general format is the following:

- For blahblah, see the [YEAR] University of Illinois Federal Tax Workbook, Volume [VOL#], Chapter [CHAP#]: [CHAPTER_TITLE]

- Example of reference to 2012-2020 workbooks:

- For more information about gift taxes, see the 2013 University of Illinois Federal Tax Workbook, Volume B, Chapter 3: Advanced Individual Issues.

- Example of reference to 2011 Fundamentals workbook:

- For comprehensive explanations of depreciation methods, see the 2011 University of Illinois Federal Tax Fundamentals, Chapter 4: Depreciation Basics.

- Example of reference to 2011 and prior years referring to an entire chapter:

- For a more thorough description of each bankruptcy chapter and the requirements for debtors, see the 2008 University of Illinois Federal Tax Workbook, Chapter 13: Financial Distress.

- Example of reference to past workbooks using specific page numbers (references to current year chapters should NEVER use specific page numbers):

- For more information, see pages 227–229 of the 2013 University of Illinois Federal Tax Workbook, Volume B, Chapter 3: Advanced Individual Issues.

- References to chapters older than the current and prior year should always be followed by the following statement:

- This can be found at uofi.tax/arc [resources.taxschool.illinois.edu/taxbookarchive].

Capitalizing “Court”

The word “court” should be capitalized in the following circumstances.

- When naming any court in full

- The United States Court of Appeals for the Ninth Circuit addressed this question in Gove v. Robinson.

- When referring to the [United States] Supreme Court.

- Justice Scalia wrote the dissenting opinion for the Court.

- When referring to the court that will be receiving that document.

- This Court should deny the Motion for Summary Judgment.

Otherwise, do not capitalize “court.”

- The Smith court considered whether a swimming pool was an attractive nuisance.

- The court in Wilson found the physician liable for failing to warn the victims about his patient’s threats against them.

Using “See” in Footnotes

Use “see” within a footnote when citing an example or helpful supplemental reference to the reader instead of citing authority for a rule or viewpoint.

Example:

Example:

Example:

Internet Addresses

Note: The formatting rules for Internet addresses referenced in text differ slightly from that used in footnotes.

We are now preceding the majority of Internet addresses in text with a shortURL (e.g., uofi.tax/16a1x5) to make them easier for people to access and then putting the full url in brackets following the shortURL. Dan will create the shortURL during typesetting.

Formatting:

- Full URL within brackets.

- Do not include http:// (only include https:// if the address fails to load when http:// is used)

- Trailing forward slashes are unnecessary. Even though they show up in the address bar, they are not required to reach that Internet address, e.g., www.fubar.com/fred/ should be referenced as [www.fubar.com/fred].

- Do not bold website addresses in text.

Examples:

… can be found at [www.whosiwhatsis.com/ridiculous].

… can be found at [https://glarf.bloatedbureaucracy.gov].

Headings. If an abbreviation has been defined in the chapter’s text that precedes the heading, it should be used in the heading. If a term that is subsequently abbreviated is used for the first time in a heading, the abbreviation should be used in the heading, provided it can be defined in the first one or two sentences of the paragraph that immediately follows.

Use of the abbreviation “IRA” should be reserved for reference to “Individual Retirement Arrangements.” References to the Inflation Reduction Act of 2022 should not be abbreviated, as this would create a redundant and confusing reference.

Miscellaneous Styles

- S corporation and C corporation — no hyphen and corporation type should be a capital letter, with the word “corporation” in lower case.

- Break even, not breakeven or break-even

- Excludable, not excludible

- Includable, not includible

- An LLC, not a LLC

- An IRC, not a IRC. Also, periods should not be used, e.g., IRC, not I.R.C.

- Code, not “Internal Revenue Code” when referring to the code in its entirety.

- An FMV, not a FMV

- TC Memo, not T.C. Memo; do NOT italicize “TC Memo XX….”

- IRS, not I.R.S. Is preceded by “the” when used as a noun; the IRS is referred to as an “it”, not “they”. When possessive, use apostrophe and ‘s’, e.g. “It is the IRS’s opinion that…”

- Conversely, IDOR (also without periods) is not preceded by “the” when used as a noun.

- Social Security should always start with caps when referring to the administration.

- social security should always start with lowercase for explaining benefits, tax, etc.

- Federal is capitalized when it is part of a proper noun (the official name of a particular or unique person, place, or thing; e.g. Federal Insurance Contributions Act); federal starts with lowercase it all other situations (e.g. federal law, federal minimum wage, federal tax return).

- SSN should always be uppercase when abbreviating.

- Phase-out, not phaseout

- Phase-in, not phasein

- Childcare, not child-care

- Healthcare (one word) when used as a modifier, and health care (two words) when used as a noun, e.g., “One has to venture into the healthcare system in order to receive health care.”

- Pass-through (hyphenated) when used as an adjective and pass through (two words) when used as a verb

- Flow-through (hyphenated) when used as an adjective and flow through (two words) when used as a verb

- Yearend, not year-end

- Canceled and cancelation, not cancelled and cancellation.

- Because is used to explain why; since is used to denote the passage of time.

- Commissioner can be abbreviated as Comm’r (no period after abbreviation in citations).

- %, not “percent,” when used with a numeral unless it is the first term in a sentence

- Recordkeeping is one word.

- Times are referenced as a whole numeral, space, “AM” or “PM” in capitals without punctuation, and then the time zone in cap/lowercase without “daylight” or “standard”, e.g., “7 AM Central Time” or “2:30 PM Eastern Time”.

- Phone numbers should be formatted using only hyphens and no parentheses: 217-867-5309.

- Rev. Rul., Ltr. Rul., Treas. Reg. – In text, use these abbreviations when referring to specific regulations. When referring to regulations in general, spell out ‘letter ruling,’ ‘treasury regulation’, etc.

- U.S. is used as an adjective (U.S. citizen) and United States is spelled out when identifying the country.

- Internet is always capitalized.

- Forgo is to give up the enjoyment or advantage of something.

Forego is used to indicate that something precedes. - Payer identifies a person or entity that remits an amount of money.

Payor is narrowly defined as a person or entity that remits money in payment of an insurance policy or a legal agreement. - Versus should be spelled out when contrasting terms are distinguished in text or footnotes. However, its abbreviation “v.” should be used with court cases.

- When referring to filing status, MFS is married filing separately and MFJ is married filing jointly. (note the inclusion of -ly at the end of each word)

Editing Standards and Recommendations

Point of View

Do not use 1st or 2nd person point of view. Avoid “you”, “your”, “we”, “our”, etc.

Defining Terms and Acronyms

Acronyms should always be defined the first time they appear in a chapter if they are used more than once. If a term is only ever used once in a chapter, don’t define the acronym; just use the full term.

When defining an acronym for the first time in a chapter, the acronym is not bolded and the initials are placed within parentheses immediately following the acronym, e.g., “… in the Tax Cuts and Jobs Act (TCJA), which subsequently…”

Exception: Do not define an acronym if it’s used for the first time in a header. In that instance, simply use the acronym and define it ASAP in text below the header following the usual standards.

Well-established industry-standard acronyms such as IRS, IRC, EA, and CPA do not need to be defined.

For nonstandard industry terms taken verbatim from a third-party source, bold the term within the text, and adapt the citation as shown in the following example.

Consequently, the tax benefit of Gina’s $15,000 SEP contribution is $2,640 ($24,315 – $21,675). This is an effective rate of 17.6% on Gina’s 2018 SEP contribution (which is Gina’s 22% marginal tax rate reduced by the 20% QBID). If Gina remains in the 22% marginal tax bracket when she retires, her tax rate on distributions will be higher (22%) than her tax rate on the contribution (17.6%) (i.e., the deduction-reduction problem5).

Use “section” rather than “chapter” where appropriate. Further uses of the term within the chapter/section do not need to be cited.

Avoid Excessive Wordiness

Before: Special rules apply with respect to the use and calculation of the $25,000 special allowance.

After: Special rules apply for calculating and using the $25,000 special allowance.

Before: Thurman has no capital losses from prior years that carry forward to 2013.

After: Thurman has no capital loss carryovers to 2013.

Before: However, guaranteed payments made in connection with the use of capital are generally included in NII.

After: However, guaranteed payments for the use of capital are generally included in NII.

Before: However, it is likely that a facts-and-circumstances analysis of each case will be taken into account as part of the determination.

After: However, it is likely that the facts and circumstances of each case will be analyzed as part of the determination.

- “With respect to” or “in regards to” can often be shortened to “for.”

- “Pursuant to” can frequently be shortened to per.”

- “Is able to” can frequently be shortened to “can.”

- “Is urged to” can frequently be shortened to “should.”

- “In order to” can be shortened to “to.”

Avoid clauses like “decides to.” A decision to do something is not a taxable event; actually doing something (selling, buying, retiring, etc.) is taxable.

Avoid Future Tense

Present tense should be used instead of future tense wherever possible.

Before: This section will cover those items that…

After: This section covers those items that…

Before: The interest expense will carry forward to 2014 under the investment interest deduction rules.

After: The interest expense carries forward to 2014 under the investment interest deduction rules.

Avoid Passive Voice

Before: Proposed regulations were drafted that address these new types of entities.

After: The IRS drafted proposed regulations that address these new types of entities.

Avoid Clauses Using “of”

… especially when there are multiple “of” clauses in close proximity.

Before: In 2012, Ricardo’s share of the partnership generates…

After: In 2012, Ricardo’s partnership interest generates…

Before: Conversion of the property of the passive activity…

After: Conversion of the passive activity’s property…

Before: The taxpayer must materially participate in operation of the rental activity.

After: The taxpayer must materially participate in operating the rental activity.

Before: …even for tax advice associated with the preparation of their tax returns.

After: …even for tax advice associated with preparing their returns.

Miscellaneous Standards

- As a general rule, try not to use more words where fewer will suffice.

- When referring to material being discussed later in the chapter, use “… is discussed later.” Do not use “will be” and do not add “in this chapter.”

- When referring to material discussed earlier in the chapter, use “…as discussed previously.” Avoid the terms “above” and “below.”

- When referring to the current section of a chapter, use “This section covers…” rather than “This section will cover…”

- Use “tax year” instead of “taxation year”. Additionally, be careful editing year references when trying to simplify. “For the 2014 tax year…” does not have the same meaning as “During 2014…”

Citation Style Guide

Quick Reference Guide

| United States Supreme Court | Comm’r v. Groetzinger, 480 U.S. 23 (1987). |

| United States Court of Appeals | Littriello v. U.S., 484 F.3d 372 (6th Cir. 2007). |

| United States District Court | Jarman v. U.S., 459 F.Supp.2d 433 (D.N.C. 2006). |

| United States Court of Federal Claims | Huskins v. U.S., 75 Fed.Cl. 659 (2007). |

| United States Tax Court | Toth v. Comm’r, 128 TC 1 (2007). Tschetschot v. Comm’r, TC Memo 2007-38 (Feb. 20, 2007). |

| Summary Opinions | Acosta v. Comm’r, TC Summ. Op. 2014-41 (Apr. 24, 2014). |

| Revenue Rulings | Rev. Rul. 2004-52, 2004-1 CB 973. |

| Revenue Procedures | Rev. Proc. 99-25, 1991-1 CB 1117. |

| Private Letter Rulings | Ltr. Rul. 200529001 (Jul. 22, 2005). |

| IRS Memoranda, Advice, and Releases | SCA 200504033 (Jan. 28, 2005). TAM 8714008 (Dec. 17, 1986). FSA 200238045 (Sep. 20, 2002). IRS News Rel. 2005-76 (Jul. 25, 2005). |

| IRS Notices and Treasury Decisions | IRS Notice 99-7, 1991-1 CB 351. TD 8346, 1991-1 CB 150. |

| IRS Publications | IRS Pub. 535, Business Expenses. IRM 5.7.5.4 (2001). |

| Public Laws | Consolidated Appropriations Act, PL 116-260, §§114(a) and (b). |

Statutes

When first citing material within the Internal Revenue Code in a chapter, include the abbreviation “IRC” followed by one space, a section symbol “§” followed by the section number. Use two section symbols when referring to multiple sections in the same cite. Subsequent citations to the same chapter use only a section symbol followed by the section number. If citing to an earlier version of the Internal Revenue Code, enclose the date in parentheses.

Section symbols are not used to start sentences. Instead, references to Internal Revenue Code sections that begin sentences should include “IRC” and the section symbol, even if the section has been previously used in the chapter (e.g., IRC §751 indicates that…).

References in text to legislation that is not a part of the Code should contain the section of the legislation first and then the short title of the act (e.g., Section 10201 of the Inflation Reduction Act of 2022 states …”).

When a citation refers to another section of the immediately prior referenced legislation, the abbreviation “Ibid.” can be followed by a comma, a space, the section symbol, and the section (e.g., “Ibid., §206.”). This rule can also be applied to Circular 230 and Treasury Regulation.

Examples

- IRC §1031.

- §1031.

- IRC §§401, 404, and 457.

- IRC §89 (1986).

- Section 10201 of the Inflation Reduction Act of 2022, imposes a …

When citing federal statutes (United States Code), indicate the title number, then “USC,” and then the section number.

Examples

- 18 USC §1001.

- See 31 USC §5321(a)(5).

For a span of sections being referred to:

- 18 USC §§1001–1005.

- The use of the definite article “the” is inconsistent in literature when it introduces a specific piece of legislation. Therefore, the Tax School uses the following guide.

| Short Title of Legislation | Text Usage Name | Usage of Definite Article “the” | Footnote Usage Name | Public Law Reference |

| SECURE 2.0 Act of 2022 | SECURE 2.0 Act | Yes | SECURE 2.0 Act of 2022 | PL 117-328 |

| Tax Cuts and Jobs Act | TCJA | No | Tax Cuts and Jobs Act | PL 115-97 |

| Inflation Reduction Act of 2022 | Inflation Reduction Act of 2022 | Yes | Inflation Reduction Act | PL 117-169 |

| Patient Protection and Affordable Care Act | Patient Protection and Affordable Care Act or ACA | Yes | Patient Protection and Affordable Care Act | PL 111-148 |

| Employee Retirement Income Security Act of 1947 | ERISA | No | Employee Retirement Income Security Act | PL 93-406 |

| American Rescue Plan Act of 2021 | American Rescue Plan | Yes | American Rescue Plan Act of 2021 | PL 117-2 |

| Consolidated Appropriations Act of 2021 | Consolidated Appropriations Act of 2021 | Yes | Consolidated Appropriations Act of 2021 | PL 116-260 |

| Coronavirus Aid, Relief, and Economic Security Act | CARES | No | Coronavirus Aid, Relief, and Economic Security Act | PL 116-136 |

| SECURE Act of 2019 | SECURE Act | SECURE Act of 2019 | PL 116-94 |

Regulations

Treasury Regulations

Include the source abbreviation “Treas. Reg.” followed by one space, a section symbol “§” followed by the section number. Use two section symbols when referring to multiple sections in the same cite.

Example:

- Treas. Reg. §1.701-1.

- Treas. Regs. §§301.9100-1 through 301.9100-3.

Proposed Treasury Regulations

Add “Prop.” to the designation.

Example:

- Prop. Treas. Reg. §301.7701-1.

Temporary Treasury Regulations

Add “Temp” to the designation. These are like final Treasury Regulations, but include a “T” after the section number (but before any subsection).

Example:

- Temp. Treas. Reg. §1.409(p)-1T.

Code of Federal Regulations

Title number, “CFR”, then section number(s).

Example:

- 16 CFR §444.

- 16 CFR §§444–452.

Preamble to a Regulation

“Preamble to” followed by the regulation in capitals, the date in parentheses, a comma, then page number (preceded by “p.” or “pp.” as appropriate), followed by a period.

Example:

- Preamble to REG-104397-18 (Aug. 8, 2018), p. 10.

IRS Rulings and Administrative Materials

Cumulative Bulletin

The Cumulative Bulletin (CB) is published semiannually and is a compilation of Internal Revenue Bulletins (IRB). The IRS stopped publishing CBs in 2008, but references to them may still be necessary.

CBs are numbered by year and volume, separated by a hyphen. IRBs 1 through 26 were republished in the first CB (Vol. 1) each year, and IRBs 27 through 52 were republished in the second CB (Vol. 2) each year. Include the source abbreviation, initial page number, and pinpoint page number when appropriate.

Always preface the CB with the corresponding Rev. Proc.

Example:

- Rev. Proc. 2003-23, 2003-1 CB 599.

Internal Revenue Bulletin

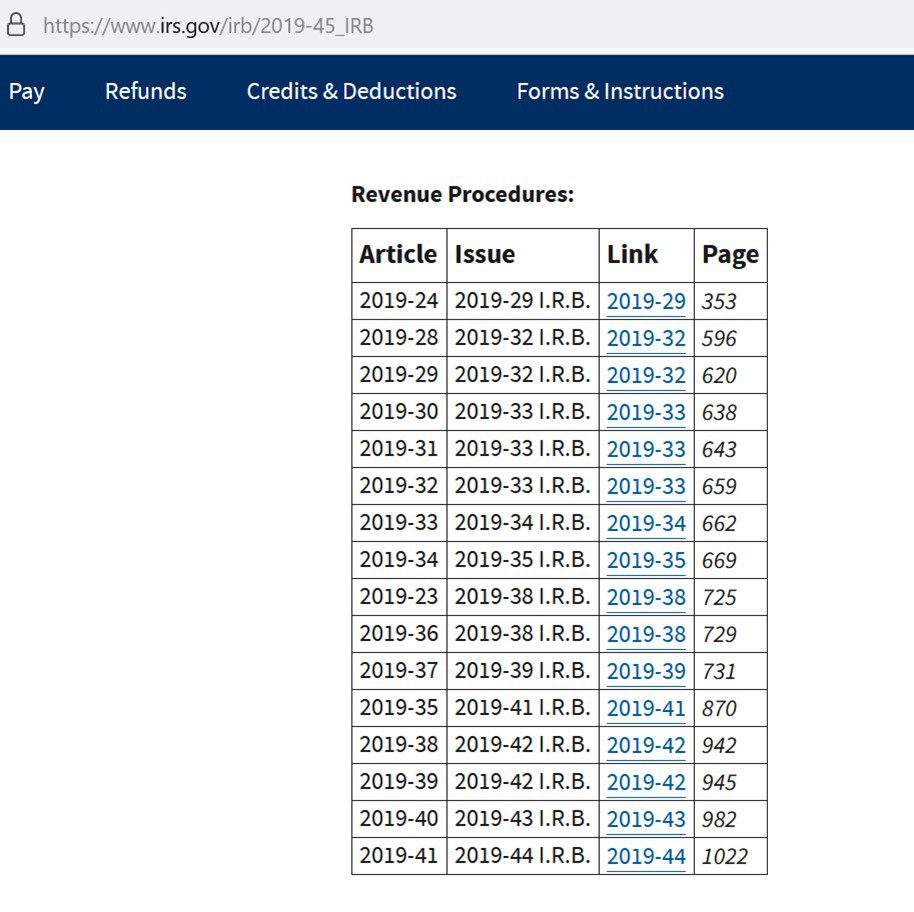

The IRB is published weekly by the IRS and contains IRS pronouncements such as Revenue Rulings, Revenue Procedures, Treasury Decisions, Notices, and Announcements. It was the advance sheet for the CB. It is numbered sequentially by year and week of issue, separated by a hyphen. Also include the source abbreviation and initial page number.

Always preface the IRB with the corresponding Rev. Proc.

Example:

- Rev. Proc. 2017-30, 2017-18 IRB 1131.

Tip. To identify the applicable IRB, look up an IRB that likely comes later than the item. For example, if you’re looking up the IRB for Rev. Proc. 2019-38 (2019 is the year, 38 means it’s the 38th Rev. Proc. of the year), go to IRB 2019-45 (again, 2019 is the year, 45 is the 45th issued during the year). At the bottom of the IRBs, they list everything that’s been published during the year. In this case, Rev. Proc. 2019-38 was actually in IRB 2019-42.

One other “cheat”, the IRS is pretty consistent with their URLs, so retype 42 over 45 (for example) to do a quick hop.

Announcements

Cite by year and sequential number of issue, separated by a hyphen. Provide a citation to the CB or IRB.

Examples:

- IRS Ann. 2004-54, 2004-1 CB 1061.

- IRS Ann. 2004-54, 2004-1 CB 1061.

Acquiescence

The IRS reviews tax decisions made by the courts and issues its own opinion about whether it agrees with the decision. The opinion is published as either an acquiescence (acq.), which means that the IRS will not contest the point in later cases; a nonacquiescence (nonacq.), which means that the IRS will not appeal but will not follow the decision with other taxpayers; or an acquiescence in result (acq. in result), in which the IRS agrees with the result of the decision, but disagrees with one or more stated reasons.

Examples:

- Lemmen v. Comm’r, 77 TC 1326 (1981), acq., 1983-1 CB 1.

- Dean v. Comm’r, 35 TC 1083 (1961), nonacq., 1973-2 CB 4.

- Golden Belt Tel. Assn., Inc., v. Comm’r, 108 TC 498 (1997), acq. in result, 1998-18 IRB 4 (May 4, 1998).

Notices

Cite by year and sequential number of issue, separated by a hyphen. Provide a citation to the CB or IRB.

Examples:

- IRS Notice 99-7, 1991-1 CB 351.

- IRS Notice 2004-78, 2004-48 IRB 879.

Treasury Decisions

Proposed and final treasury regulations are issued by the Secretary of Treasury as Treasury Decisions (TD). Proposed regulations are identified by a REG prefix followed by a project number. Provide a citation to the CB or IRB.

Examples:

- TD 9154, 2004-40 IRB 560.

- TD 8346, 1991-1 CB 150.

- REG-255786-97, 1997-11 IRB 19.

Revenue Procedures

Cite by year and sequential number of issue, separated by a hyphen. Provide a citation to the CB or IRB.

Examples:

- Rev. Proc. 99-25, 1991-1 CB 1117.

- Rev. Proc. 2005-38, 2005-28 IRB 81.

Revenue Rulings

Cite by year and sequential number of issue, separated by a hyphen. Provide a citation to the CB or IRB.

Examples:

- Rev. Rul. 2004-52, 2004-1 CB 973.

- Rev. Rul. 99-56, 1999-1 CB 676, revoking Rev. Rul. 66-9, 1966-1 CB 39.

- Rev. Rul. 2005-46, 2005-30 IRB 120.

Federal Register

A citation consists of the volume number, “Fed. Reg.,” page number, and date.

Example:

- 68 Fed. Reg. 18,564 (Apr. 23, 2013).

Publicly Released IRS Pronouncements

For most IRS pronouncements, cite by reference number followed by the exact date of issue in parentheses. Do not use the date of decision, if it differs from the date of issue. Months are abbreviated to three letters.

Examples:

| Letter Ruling | Ltr. Rul. 9031022 (May 7, 1990). Ltr. Rul. 200529001 (Jul. 22, 2005). |

| Service Center Advice | SCA 200504033 (Jan. 28, 2005). |

| Technical Advice Memorandum | TAM 8714008 (Dec. 17, 1986). |

| Field Service Advice | FSA 200238045 (Sep. 20, 2002). |

| Chief Counsel Advice | CCA 200119054 (May 11, 2001). |

| Action on Decision | AOD 200020 (Apr. 28, 2000). |

| News Release | IRS News Rel. IR-2005-76 (Jul. 25, 2005). |

| Advice Memorandum | AM 2024001 (Feb. 5, 2024). |

Forms and Publications

IRS Forms

Cite by number. It is appropriate to include an italicized title after the citation when the form is first cited in the chapter; footnotes always require the entire citation. Subsequent references to the form within the same chapter do not require the title.

Examples:

- Form 1040, U.S. Individual Income Tax Return.

- Form 1099-C, Cancellation of Debt Statement.

Instructions for IRS Forms

Cite only by form number without formal title. There may be rare cases where a change in instructions is emphasized, in which case preceding the form reference with the year is appropriate. Please check with SME team before deviating from the initial standard.

Examples:

- Instructions for Form 1040.

- 2022 Instructions for Form 1065.

IRS Schedules

Within text, there may be times when the same schedule number appears in multiple forms (e.g., Schedule K-1). It is appropriate to refer to the schedule with the appropriate form number following in parentheses.

Examples:

- Schedule K-1 (Form 1065).

- Schedule K-1 (Form 1120-S).

Instructions for IRS Schedules

Cite by form number, comma, and then schedule number/letter. There may be rare cases where a change in instructions is emphasized, in which case preceding the form reference with the year is appropriate. Please check with SME team before deviating from the initial standard.

Examples:

- Instructions for Form 1040, Schedule 1.

- 2022 Instructions for Form 1065, Schedule K-1.

IRS Publications

Cite by IRS publication number, italicized title, pinpoint page if available and needed, and year (but only if specific page number(s) cited). The word “publication” is capitalized and abbreviated. It is appropriate to include an italicized title after the citation when the publication is first cited in the chapter; footnotes always require the entire citation.

Examples:

- IRS Pub. 17, Tax Guide for Individuals, p. 31 (1998).

- IRS Pub. 535, Business Expenses.

Internal Revenue Manual

The Internal Revenue Manual (IRM) is cited in decimal format. The first digit is the part number, the second number is the chapter number, the third number is the section number, and the fourth number is the subsection number. Enclose the year of issue in parentheses.

Examples:

- IRM 5.7.5 (1996).

- IRM 5.7.5.4 (2001).

Court Cases

A full citation for a case may contain as many as nine components. However, most will contain fewer. These are case name, reporter volume, reporter abbreviation, initial page, pinpoint page, (court abbreviation, date), subsequent history designation, subsequent history citation [if any].

Example:

- Dept. of Revenue of Montana v. Kurth Ranch, 986 F.2d 1308 (9th Cir., 1993), aff’d 511 U.S. 767 (1994).

Case Name

Italicize the case name and the comma that follows. When the Commissioner of Internal Revenue is a party, use “Comm’r” as an abbreviation. When the United States is a party, use “U.S.”

In the Rulings and Cases chapter, headings should show the complete case names, showing the plaintiff to the left of “v.” The plaintiffs’ first and last names should appear, although the last name should appear only once for a married couple using the same last name (e.g., George Anton and Ellen Jones Remisovsky v. Comm’r). When appearing in H1 or H2 headings, case names should appear in roman type, but italic type should be used for case names in other headings, text, and footnotes.

Reporter Volume

After the case name, include the volume number of the cited reporter. Insert one space before and after the volume number.

Reporter Abbreviation

After the volume number, include the abbreviation for the reporter in which the case appears. Insert one space after the reporter abbreviation. Common reporter abbreviations are listed below:

| U.S. | United States Reports (Supreme Court) |

| S.Ct. | Supreme Court Reporter |

| F., F.2d, F.3d | Federal Reporter (Circuit Court of Appeals Opinions) |

| Fed.Appx. | Federal Appendix (Circuit Court Rulings) |

| F.Supp., F.Supp.2d | Federal Supplement (U.S. District Courts) |

| TC | U.S. Tax Court Reporter |

| TC Memo | U.S. Tax Court (Memorandum opinions) |

| Fed.Cl., Cl.Ct. | Federal Claims Reporter |

Page Numbers

After the reporter abbreviation, include the initial page number, which is the page on which the case begins. If referring to specific pages with the case (such as when quoting passages), also include the relevant pinpoint references.

Court Abbreviation

Include the abbreviation for the court that decided the case. However, do not use an abbreviation for those courts that only publish in specific reporters (U.S. Supreme Court, Tax Court, Claims Court).

Date

After the court abbreviation, if any, include the date on which the case was decided in parentheses. Include only the year for cases published in reporters. For unpublished cases and cases available only in online or looseleaf format, provide the exact date (month-day-year) of the decision to help readers locate the case. When providing the exact date, abbreviate the month.

Examples:

- Sean P. McNamee v. U.S., 488 F.3d 100 (2nd Cir. 2007).

- Colorado Mufflers Unlimited, Inc., v. Comm’r, TC Memo 2007-222 (Aug. 13, 2007).

Subsequent History Designation

Include subsequent history, if any. Also indicate when a judgment in a cited case has been overruled. Include a citation to the subsequent history when possible. Designation should be italicized and no period follows the abbreviation.

| Affirmed | aff’d |

| Affirming | aff’g |

| Certiorari denied | cert. denied |

| Reversed | rev’d |

| Reversing | rev’g |

United States Supreme Court

The reporters are United States Reports (U.S.) and the Supreme Court Reporter (S.Ct.).

Examples:

- Comm’r v. Groetzinger, 480 U.S. 23 (1987).

- Hinck v. U.S., 127 S.Ct. 2011 (2007).

United States Circuit Courts of Appeal

The reporters are the Federal Reporter (F., F.2d, F.3d) and the Federal Appendix (Fed.Appx.). Cite the reporter when available.

Examples:

- Littriello v. U.S., 484 F.3d 372 (6th Cir. 2007).

- U.S. v. Tuff, 469 F.3d 1249 (9th Cir. 2006).

- Glass v. Comm’r, 471 F.3d 698 (6th Cir. 2006), aff’g 124 TC 258.

United States District Courts

The reporter is the Federal Supplement (F.Supp., F.Supp.2d). Cite the reporter when available.

Example:

- Jarman v. U.S., 459 F.Supp.2d 433 (D.N.C. 2006).

Nonpublished

Example:

- Stearn & Co. LLC v. U.S., No. 2:06-cv-14923 (E.D.Mich. Jun. 29, 2007).

United States Tax Court

The reporter is the Tax Court Reporter (TC). Cite the reporter when available. The Tax Court also issues important opinions that are not bound in the reporter, most notably its Memorandum Decisions.

Examples:

- Toth v. Comm’r, 128 TC 1 (2007).

- Tschetschot v. Comm’r, TC Memo 2007-38 (Feb. 20, 2007).

Court of Federal Claims

The reporter is the Federal Claims Reporter (Fed.Cl.). Cite the reporter when available.

Examples:

- Fisher v. U.S., 28 Fed.Cl. 88 (1993).

- Huskins v. U.S., 75 Fed.Cl. 659 (2007).

- Eugene A. Fisher, Trustee, Seymour P. Nagan Irrevocable Trust v. U.S., No. 04-1726T (Fed. Cl. Nov. 15, 2006) (unpublished opinion related to 69 Fed.Cl 193 (2006)).

Commercial Electronic Database Citations

Online reporter citations are frequently issued to cases after the court’s ruling. Westlaw and Lexis are the most common online reporter citations.

Examples:

- Davis v. Latschar, No. 99-5037, 2000 U.S. App. LEXIS 2525 (D.C. Cir. Feb. 22, 2000).

- Holtzman v. Turza, No. 08 C 2014, 2008 WL 2510182, at *3 (N.D. Ill. Jun. 19, 2008).

Generally, do not use commercial electronic database citations. Instead, find a published copy of the case online and cite the case as a webpage. Commercial electronic database citations should only be used as a last resort.

Books and Treatises

A full citation to a book or treatise may contain as many as eight components. These are author, title, pinpoint reference, (editor [if any], translator [if any], edition [if any], publisher, date).

Example:

- Sydney S. Traum & Judith Rood Traum, The S Corporation Answer Book, 8-29 (6th ed., Aspen, 2001).

Author’s Name

Give the author’s full name, exactly as it appears on the front cover or title page. Full name includes designations such as “Jr.” and “III” but not degree or title information, such as JD, CPA, or EA.

If there are multiple authors, include each author’s full name, in the order the names appear on the front page or title page. If there are two authors, separate their names with an ampersand “&.” If there are more than two authors, separate each name from the next with a comma, except the last two names, which should be separated by an ampersand only. Alternatively, you may use the phrase “et al.” after the author’s first name to indicate that the work has three or more authors. There is no comma before “et al.”

Examples:

- John Smith & Jane Doe

- John Smith, Jane Doe & Joe Doakes

- John Smith et al.

Organizational Author

If the author is an organization, give the full name of the organization as it appears on the front page or title page.

Example:

- RIA, Federal Tax Handbook (2007 ed., Thomson-RIA, 2006).

Title

Present the full title as it appears on the cover or title page. You may include a subtitle. If included, separate the subtitle by using a colon.

Example:

- Gary Hoff & Alfred E. Neuman, LLCs Taxed as Partnerships: Formation to Dissolution (2007 ed., Univ. of Illinois, 2007).

Speeches and Oral Presentations

A full citation to an unpublished speech, address, or other oral presentation consists of six elements. These are the speaker’s name [include speaker’s title if speaker is not generally know], type of presentation, subject or title of presentation, (place of presentation, exact date), and (location of source).

Example:

- Lisa McLance, Project Manager, IRS Office of Professional Responsibility, Address, Forms 23 & Form 8554 Redesign (Washington, D.C., Oct. 18, 2007) (copy of transcript on file with the IRS SB/SE National Practitioner Forum).

If the presentation has been published, use the following format: Speaker’s name, type of presentation, subject or title of presentation, (place of presentation, exact date). If published online, treat as a web page citation as shown below.

Example:

- Derrick A. Bell, Jr., Lecture, California’s Proposition 209 (Loyal Law School, L.A., Cal., Jan. 17, 1997), in 30 Loy. L.A. L. Rev. 1447 (1997).

Articles

Magazines/Periodicals

Examples:

- Wheatcroft, G. (2004, Jun.). The Tragedy of Tony Blair. The Atlantic, 293, 56–72.

- Thomas, E. & Hosenball, M. (2004, May 31). Bush’s Mr. Wrong: The Rise and Fall of Chalabi. Newsweek, 143, 22–32.

Newspaper Articles

If the article is “signed” (that is, the author’s name is known), begin with that author’s name. (Notice how discontinuous pages are noted and separated by commas.) Do not omit the “The” from the title of a newspaper.

Example:

- Poirot, C. (2004, March 17). HIV prevention pill goes beyond ‘morning after.’ The Hartford Courant, pp. F1, F6.

If the author’s name is not available, begin the reference with the headline or title in the author position.

Example:

- New exam for doctor of future. (1989, Mar. 15). The New York Times, p. B-10.

If the text being cited is from an editorial or letter to the editor indicate the nature of the source in brackets after the title and date.

Example:

- Silverman, P.H. (2004, Jun.). Genetic Engineering [Letter to the editor]. The Atlantic, 293, 14.

Web Pages

A citation for a web page includes the following elements, if available, in this order:

- Web page title (in italics, followed by a period unless #2 applies, in which case a comma is used)

- Page numbers or range (for PDFs only, preceded by “p.” or “pp.” and followed by a period)

- Author (last name, first name, followed by a period)

- Date of publication (followed by a period)

- Sponsoring organization (followed by a period)

- Full URL within brackets (do not include http:// or https:// before the URL unless one of them does NOT take you to the reference in question and an explicit prefix is required)

- “Accessed on” followed by date of retrieval (followed by a period)

Examples:

- The William Faulkner Society Home Page. Ed. Mortimer, Gail. Sep. 16, 2003. William Faulkner Soc. [www.acad.swarthmore.edu/faulkner] Accessed on Oct. 1, 2007.

- NAIC Online. Sep. 29, 1999. National Association of Inventors Corporation. [www.better-investing.org] Accessed on Oct. 1, 1999.

- U.S. Department of Education (ED) Home Page. Apr. 4, 2008. U.S. Dept. of Education. [www.ed.gov/index.html] Accessed on May 5, 2008.

- National Taxpayer Advocate Objectives Report to Congress Fiscal Year 2019, p. 80. National Taxpayer Advocate. [taxpayeradvocate.irs.gov/Media/Default/Documents/2019-JRC/JRC19_Volume1.pdf] Accessed on July 17, 2018.

- Topic Number 429—Traders in Securities (Information for Form 1040 Filers). Mar. 1, 2018. IRS. [www.irs.gov/taxtopics/tc429] Accessed on Apr. 3, 2018.

Podcasts

A citation for a podcast includes the following elements, if available, in this order:

- Host last name, First Initial (followed by a period. Add (Host). afterwards. If two hosts, include ampersand in between.)

- Date of episode (in parentheses, Year comma Month Date. End with a period)

- Episode title (no punctuation)

- Episode number (in parentheses, no punctuation)

- [Audio podcast episode] followed by a period

- In Podcast Name (followed by a period)

- Production Company (followed by a period)

- Full URL within brackets (do not include http:// or https:// before the URL unless one of them does NOT take you to the reference in question and an explicit prefix is required)

- “Accessed on” followed by date of retrieval (followed by a period)

Footnotes

- For more information about plagiarism and paraphrasing, see Avoiding Plagiarism—Paraphrasing. Massachusetts Institute of Technology. [https://integrity.mit.edu/handbook/academic-writing/avoiding-plagiarism-paraphrasing] Accessed on Oct. 23, 2018. ↩︎

- Material is from Unpaid Tax At Death—How Long Does IRS Have to Collect? McEowen, Roger A. Nov. 15, 2018. Agricultural Law and Taxation Blog. [https://lawprofessors.typepad.com/agriculturallaw/2018/11/unpaid-tax-at-death-how-long-does-irs-have-to-collect.html] Accessed on Nov. 27, 2018. ↩︎

- Unpaid Tax At Death—How Long Does IRS Have to Collect? McEowen, Roger A. Nov. 15, 2018. Agricultural Law and Taxation Blog. [https://lawprofessors.typepad.com/agriculturallaw/2018/11/unpaid-tax-at-death-how-long-does-irs-have-to-collect.html] Accessed on Nov. 27, 2018. ↩︎

- Unpaid Tax At Death—How Long Does IRS Have to Collect? McEowen, Roger A. Nov. 15, 2018. Agricultural Law and Taxation Blog. [https://lawprofessors.typepad.com/agriculturallaw/2018/11/unpaid-tax-at-death-how-long-does-irs-have-to-collect.html] Accessed on Nov. 27, 2018. ↩︎