Because of tax credits created by the Inflation Reduction Act (IRA) for clean fuel production, some farmers may in the near future receive a higher price for selling crops to renewable fuel producers (i.e. ethanol and biodiesel plants) if they implement “climate-smart agricultural practices.” The IRA tax credits are available to the producers of the fuel, not the farmers, but the credit amount may be increased if the fuel producers purchase corn or soybeans from farmers reducing carbon emissions through practices such as cover crops and no-till farming. It is expected that fuel producers seeking credits will pay these farmers a higher price for their grain, but the amount of the premium remains to be seen. IRS is still finalizing the details on the calculation of these credits, but it is important that farmers follow developments so they are prepared to benefit as new opportunities arise.

Note: A tax credit is a dollar-for-dollar offset of income tax liability, while a tax deduction reduces the taxable income against which the income tax rate is applied. In other words, a tax credit is generally more valuable than a tax deduction. In addition to expanding and creating new tax credits, the IRA also allows fuel producers with insufficient tax liability to transfer these credits to another taxpayer in exchange for money.

IRC §40B Credit Overview

Congress created the IRC §40B sustainable aviation fuel tax credit for producers of sustainable aviation fuel (SAF) that meets certain emissions requirements set forth in the law. This credit—which ranges from $1.25 per gallon to $1.75 per gallon—is available only for 2023 and 2024 and only for SAF certified to have a lifecycle greenhouse gas emissions reduction percentage of at least 50 percent. This means the SAF must emit at least 50 percent less greenhouse gas throughout its lifecycle than comparable petroleum-based jet fuel. The projected reduction percentage is calculated through complex scientific modeling discussed later in this post.

IRC §45Z Credit Overview

In 2025, the IRC §40B credit will be replaced by the IRC §45Z clean fuel production tax credit. The IRC §45Z credit applies to qualifying transportation fuel produced after December 31, 2024, and sold on or before December 31, 2027. The §40B and §45Z credits reimagine earlier fuel credits based solely upon technology, instead requiring a quantified reduction of greenhouse gas emissions throughout the lifecycle of the fuel production.

The IRC §45Z credit will apply to two types of “clean” transportation fuel:

- Sustainable aviation fuel (SAF)

- Non-aviation sustainable transportation fuel

The maximum baseline credit for SAF will be $.35/gallon. This amount will increase to $1.75 per gallon if prevailing wage and apprenticeship requirements are met. The maximum baseline credit for non-aviation sustainable transportation fuel will be $.20/gallon. This amount will increase to $1.00 per gallon if prevailing wage and apprenticeship requirements are met.

Calculation of the IRC § 45Z Credit

To determine the IRC §45Z credit, the maximum baseline credit amount is multiplied by an “emissions factor.” The more carbon dioxide equivalent emitted by the fuel (emissions rate), the lower the emissions factor. An emissions factor of “1” is optimal because it means that no carbon dioxide was emitted in the fuel production. To qualify for the credit, transportation fuel cannot have an emissions rate of 50 kilograms of CO2e per mmBTU (one million British thermal units) or more. In other words, an emissions rate of 50 or more yields an emissions factor of 0. For SAF, an emissions rate of 25, for example, would yield a tax credit of 88 cents per gallon, if the producer meets the prevailing wage and apprenticeship requirements.

Determining the Emissions of the Fuel

IRA directed the IRS to determine the lifecycle emissions of the fuel through scientific modeling.

Specifically, in the case of sustainable transportation fuel, which is not SAF, the lifecycle greenhouse gas emissions of the fuel is to be based on the most recent determinations under the Greenhouse gases, Regulated Emissions, and Energy use in Transportation model (GREET model) developed by Argonne National Laboratory, or a successor model (as determined by the Secretary of the Treasury). In the case of SAF, the lifecycle greenhouse gas emissions of the fuel is to be determined in accordance with the most recent Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) or any similar methodology which satisfies the criteria under section 211(o)(1)(H) of the Clean Air Act (42 U.S.C. 7545(o)(1)(H).

These directives merely instruct the IRS as to the type of modeling that must be developed. New models must be developed for each credit and each type of fuel.

IRC §40B Guidance

On April 30, 2024, the IRS issued guidance for the IRC §40B credit. [IRS Notice 2024-37]. The guidance incorporated a new GREET model developed by the Department of Energy specifically for the IRC §40B credit, which expires at the end of 2024. Because similar principles apply to IRC §40B and IRC §45Z credits, the guidance provides some insight into how IRS may develop a model and guidance for the IRC §45Z credit.

Of particular interest to agricultural producers who sell crops to biofuel producers, the IRC §40B GREET model determines that the following practices result in quantifiable greenhouse gas emissions reductions.

- Carbon capture and sequestration

- Using renewable natural gas in the production process

- Using renewable power to produce the fuel

- Purchasing feedstocks from producers who meet the requirements of the “safe harbor” climate smart agriculture pilot program

Climate Smart Agriculture Pilot Program

Because the model determined that purchasing feedstocks from farmers who implement certain practices would reduce the overall greenhouse gas emissions of the fuel production, the IRS worked with the USDA to initiate a Climate Smart Agriculture (CSA) Pilot program. The USDA determined that CSA practices can lower emissions and sequester more carbon than conventional farming practices, but that such practices are not incorporated into existing lifecycle greenhouse gas emissions models. The USDA therefore created the CSA Pilot Program to estimate greenhouse gas reduction and carbon sequestration benefits from using crops grown using CSA practices in the production of SAF. Recognizing the difficulties of quantifying and verifying actual greenhouse gas emission reductions from implementing these practices, the notice establishes a “safe harbor” for using CSA crops cultivated pursuant to the USDA CSA Pilot Program. The safe harbor prescribes an inflexible bundle of practices in exchange for a fixed reduction in the fuel’s emissions score.

Corn Requirements. To qualify for the safe harbor, corn producers must engage in three CSA practices on the same acreage:

- No-till farming

- Planting cover crops

- Applying enhanced efficiency nitrogen fertilizer

Soybean Requirements. To qualify for the safe harbor, soybean farmers must engage in two CSA practices on the same acreage:

- No-till farming

- Planting cover crops

Calculating the IRC §40B Credit Using CSA Safe Harbor

The formula for calculating the IRC §40B credit is different than that for the IRC §45Z credit explained above, but the principles are similar. To qualify for the IRC §40B credit, the SAF must be certified to reduce greenhouse gas emissions by at least 50 percent. This minimum reduction qualifies the SAF producer for a base credit of $1.25/gallon. The guidance establishes that if crops grown with CSA practices are used to produce SAF, the life cycle emissions reduction for corn is “10” and the life cycle emissions reduction for soybeans is “5.” When integrated into the overall GREET formula, this prescribed factor can qualify the producer for a credit or increase the credit amount already available. Until further notice, for purposes of calculating the emissions reduction percentage, the IRS will treat the lifecycle greenhouse gas emissions of petroleum-based jet fuel as equal to 89 grams of carbon dioxide equivalent per megajoule of energy or 89 gCO2e/MJ as the baseline.

Example – Calculating the IRC §40B Credit

A registered SAF producer creates ethanol-based SAF using 100 percent CSA corn. Applying the GREET model established by the notice, the SAF has a calculated life cycle emissions value (LSf) of 51.8 gCO2e/MJ (grams of CO2 equivalent per megajoule reduction). This LSf can be reduced by the CSA reduction of 10 gCO2e/MJ because the producer purchased 100 percent CSA corn. The emissions reduction percentage (rounding down to the nearest whole percent) is calculated as follows:

[(89 gCO2e/MJ – (51.8 gCO2e/MJ – 10 gCO2e/MJ)) / 89 gCO2e/MJ] x 100% = 53.03%, rounded down to 53%.

This example demonstrates that without the CSA practices, the percent reduction for the SAF is 41.8 percent, which would not qualify for the IRC §40B credit. With the CSA practices integrated into the lifecycle of the fuel, the percent reduction is 53 percent, and it will qualify for a $1.28/gallon credit. The fuel has an emissions reduction of 50 percent or greater, and each reduction percent above 50 yields a one-cent addition to the base $1.25/gallon credit.

Additional CSA Requirements

In addition to the above rules, the CSA pilot program incorporates the following requirements:

- The CSA farmer must meet specific and detailed recordkeeping requirements for each practice. Some recordkeeping must be completed before the practices are implemented.

- Each practice must be certified through an unrelated party certification process.

- The farmer must have a contract with the SAF producer, and the SAF producer is required to collect and maintain its own records of the CSA practices.

- Records must demonstrate the traceability of the grain through the supply chain.

- Unrelated party certifiers must verify CSA practices and supply chain traceability.

- The unrelated party certifiers must have accreditation from the ANSI National Accreditation Board (ANAB) for ISO 14065 and must be a certified crop advisor or a USDA technical service provider through NRCS.

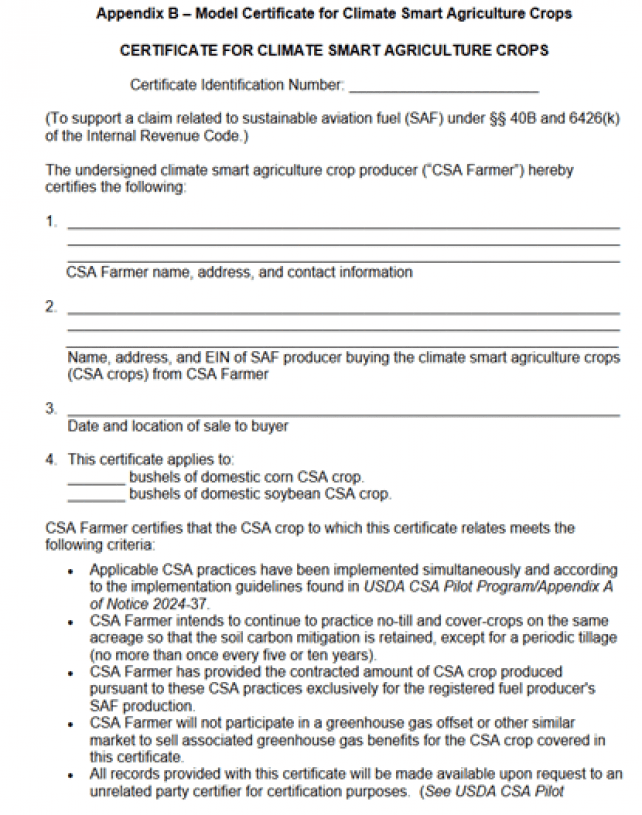

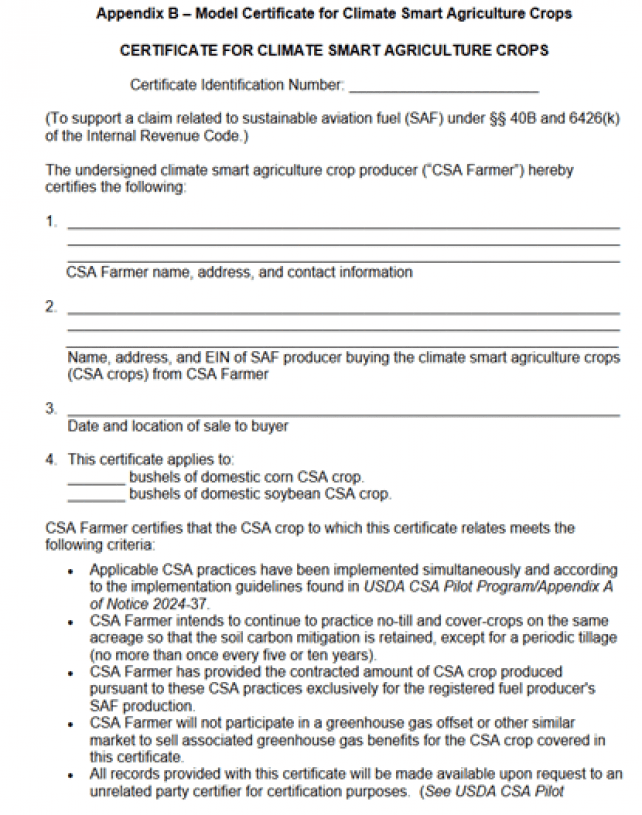

- The farmer must provide a certificate to the SAF producer to support the producer’s claim for the IRC §40B credit (Page one of the sample CSA Certificate is shown below).

- Farmers must certify that they have not and will not sell a greenhouse gas offset credit or otherwise sell associated greenhouse gas benefits for the same acreage.

- Farmers must attest that they intend to continue to practice no-till and cover crops on the same acreage so that the soil carbon continues to be sequestered and stored, except for a periodic tillage (no more than once every five or ten years).

Considerations for Farmers

Although the guidance for the IRC §40B credit was effectively issued too late to allow farmers to engage in the CSA pilot program before the credit expires, it does signal the direction the IRS may be heading with respect to the IRC §45Z credit. Farmers interested in receiving a premium corn or soybean price for implementing CSA practices should communicate with their local biofuel producers to see how they are planning for future IRC §45Z guidance. The farmers should also consult with agronomists or other advisors to determine the feasibility of implementing the bundle of CSA practices specified in the CSA pilot program.

On June 26, 2024, the USDA issued a request for information seeking feedback on “opportunities to better reflect lower greenhouse gas emissions for biofuel feedstocks grown with climate-smart practices.” The comment period expired July 26, 2024. It is possible that the IRC §45Z guidance may use these comments to create different requirements than the prescribed bundle of practices required by the IRC §40B CSA pilot program. It is likely that more farmers would implement more CSA practices pursuant to a program offering a menu of choices instead of an inflexible package.

Restrictions and Potential Penalties

Farmers considering their options under the CSA pilot program or similar future programs developed for IRC §45Z should consider the restrictions. The rules of the current CSA pilot program specifically prohibit the farmer from participating in carbon credit or offset programs for the same acres. There does not appear to be a restriction on participation in EQIP or CSP programs. Additionally, the farmers are binding themselves to continue to practice no-till and cover crops on the same acreage so that the soil carbon continues to be sequestered and stored, except for a periodic tillage occurring no more than once every five or ten years. There is no specific penalty or fine specified in the guidance for failing to follow this requirement. However, the guidance states that the fraudulent use of the CSA certificate may subject a CSA Farmer and all parties making any fraudulent use of this certificate to a fine or imprisonment, or both, together with the costs of prosecution. Although this guidance does not apply to the IRC §45Z credit, it does suggest that future opportunities may also require significant paperwork and restrictions on future farming practices.

This topic will also be covered at the upcoming Sept. 26 seminar, Forward-Thinking Tax Solutions for Farm Clients.

Original article published August 1, 2024. Reprinted here with permission.

By Kristine Tidgren

Director, Center for Agricultural Law & Taxation

Adjunct Assistant Professor, Agricultural Education

Iowa State University