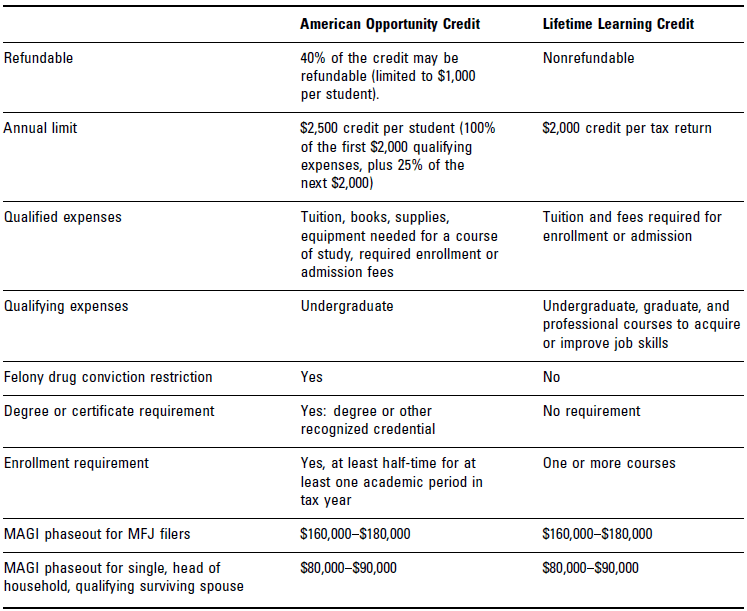

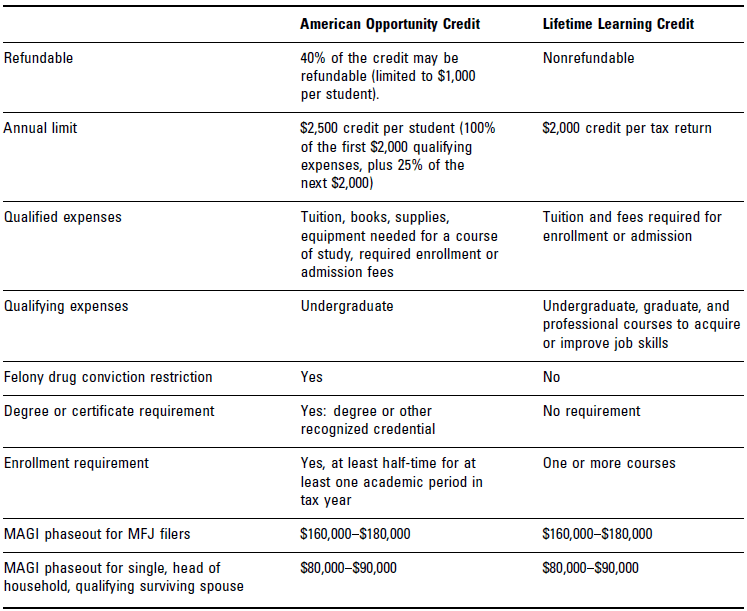

Two credits are available to reduce the cost of higher education for taxpayers, their spouses. and their dependents: the American Opportunity Credit (AOC) and the lifetime learning credit. The following table compares the two credits.

In evaluating the two credit options, several factors warrant consideration.

- For each student, either the AOC or the lifetime learning credit may be claimed, but not both. If both credits are available, the AOC will always be greater than the lifetime learning credit.

- If qualified educational expenses are paid for more than one student, taxpayers can choose to claim the AOC for one student and the lifetime learning credit for another student in the same year. The AOC limitation is per student, not per tax return filed. The lifetime learning credit limit is per tax return, not per student.

- Unlike the AOC, there is no limit on the number of years the lifetime learning credit can be claimed for each student. The AOC is limited to four years.

Note. For more information on qualifications and calculations for the lifetime learning credit and the AOC, see the 2019 University of Illinois Federal Tax Workbook, Volume A, Chapter 1: lndividual Taxpayer Issues. This can be found at uofi.tax/arc.

The above text is adapted from the 2023 University of Illinois Federal Tax Workbook, Chapter 9: Individual Taxpayer Issues.

Stay up-to-date!

SIGN UP FOR EMAIL NOTIFICATIONS