New 2025 Tax Rates and Thresholds

With the 2024 tax filing season around the corner, practitioners should also keep in mind 2025 tax numbers and rates that will impact their clients for the coming year. The…

November 18th, 2024

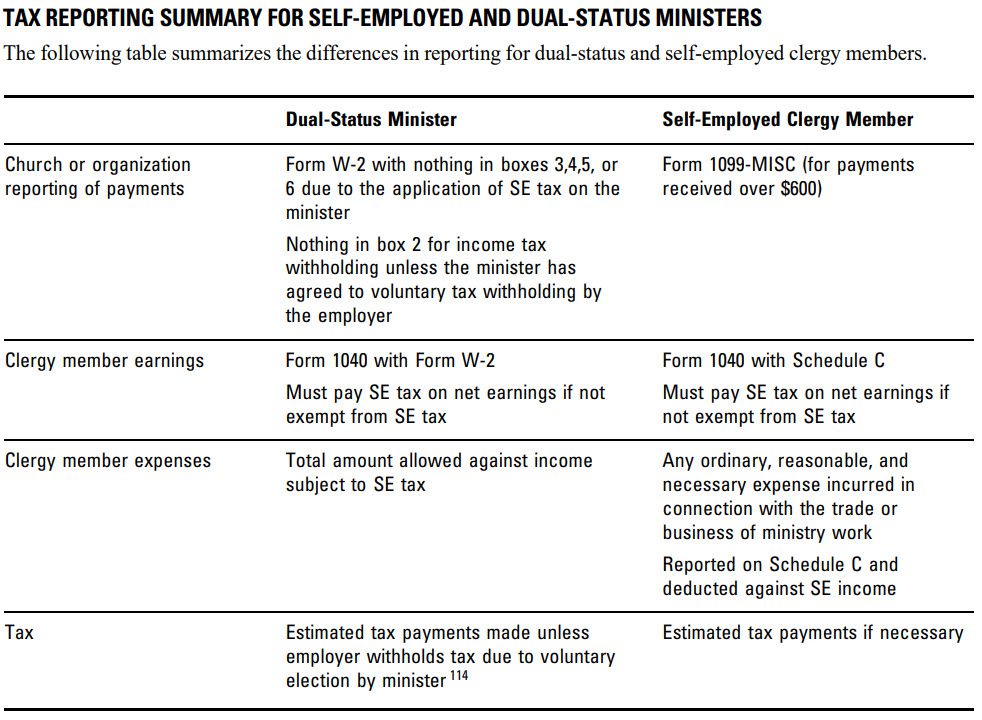

Determining whether a minister is deemed self-employed or an employee is essential because this governs how the minister is taxed. In common law, a worker is classified as either self-employed or as an employee, and the same applies to ministers.

Ministers who are employed by a church receive “dual-status” tax treatment. For income tax reporting purposes they are considered employees. However, ministers are treated as self-employed taxpayers for social security and Medicare purposes and must pay self-employment (SE) tax on their earnings, unless they are exempt.

In contrast, ministers categorized as self-employed independent contractors under the right-to-control test may have various sources and types of SE income that are subject to SE tax.

Self-employed ministers may deduct all ordinary and necessary business expenses related to their ministerial services on Schedule C. This includes expenses incurred while working as other than a common-law employee.

If the IRS approves an SE tax exemption for a self-employed minister, the SE exemption applies to income from any activity in the exercise of a ministry.

This is a reprint from the 2019 University of Illinois Federal Tax Workbook, Volume B, Chapter 6: Special Taxpayers, available at uofi.tax/arc.

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.

Join 2,200 of your colleagues and get notified each time a new post is added.