Most tax preparers have their hands full this time of year, with the due date for individual income tax returns and trusts less than a month away. Clients generally want their returns finished immediately. They often have little patience or compassion for how the compression of tax season affects practitioners personally. Sometimes it’s hard just to hang on, as the picture shows.

Most tax preparers have their hands full this time of year, with the due date for individual income tax returns and trusts less than a month away. Clients generally want their returns finished immediately. They often have little patience or compassion for how the compression of tax season affects practitioners personally. Sometimes it’s hard just to hang on, as the picture shows.

Fortunately, this is an excellent time to consider the qualified revocable trust (QRT) election for trusts associated with taxpayers who passed away during 2021. Also known as the §645 election, it offers several benefits for trustees and beneficiaries. The election for QRTs is provided in Section §645 of the Code and the associated regulations. We’ll see that as it benefits trustees, it can also benefit tax practitioners, especially at this time of year. We refer to it as the “§645 election” in this article.

How the §645 benefits practioners and trust clients

In late March, most tax practitioners feel overwhelmed with clients’ work and demands. To the extent that the work comes from new trusts, the §645 election provides a way to even the workload. Because this election enables the trustee to choose a fiscal year other than a calendar year, the tax practitioner may be able to undertake most of the work preparing the trust’s tax return in the summer or autumn when time demands are less severe. So while the big benefits to the §645 election belong to the trust itself, the tax practitioner also benefits from potentially smoothing their workload over the year. In late March, that seems like a good way to hang on.

Even though tax practitioners can benefit from the §645 election, their trust clients can likely benefit more. Trusts usually are required to use a calendar year. This timing means that tax returns for trusts are due on the same day as tax returns for individuals. The big benefit for new trusts from the §645 election arises from their ability to choose a fiscal year for their first two years of existence, and in some cases, longer.

The §645 treats trusts like part of estates

This is beneficial because estates can choose a fiscal year-end. An estate’s first fiscal year must end by the last day of the calendar month before the first anniversary of death. For example, a trust set up by a person who died in May 2021 could elect a fiscal year ending April 30, 2022. In this case, the election provides the trustee with four additional months to distribute or liquidate the trust’s assets so that it can be terminated. If the trust is terminated, a final Form 1041, U.S. Income Tax Return for Estates and Trusts, can be filed. Trusts typically cannot select a fiscal year-end, but estates can.

The trustees utilize the tax code to take advantage of the fact that an estate can have a fiscal tax year, whereas a trust generally cannot. By electing to treat a qualified revocable trust as an estate under the rules and regulations of IRC §645, the trustee can choose a fiscal year to the benefit of the trust’s beneficiaries. By choosing a fiscal year that lasts almost 12 calendar months, instead of only the portion of the calendar year that remains, trustees have more time to complete their work under the time frame limited by a single tax return. If there is a related estate, the tax practitioner and the trustee must maintain the accounting for the trust separate from the estate.

An example

Consider the hypothetical example of Harold, an unmarried individual who set up a trust many years before his death in December 2019. The trustee, Lloyd, knows that even though Harold managed his assets well, it is impossible to account for them and make distributions to the beneficiaries before the end of the month. December 31 will close the first tax year for Harold’s trust if Lloyd does not make a section §645 election to treat the trust as an estate.

If, instead, the trustee makes the §645 election, they have until November 30 of the following year to potentially wrap up the trust and possibly file a single tax return. Completing these actions in a year is a realistic objective in many cases, especially when the trust’s disposition is not in dispute.

Depending on how the trust instrument was written, having nearly a full year to distribute assets may make it easier for a trustee to align distributions with income. For example, an individual with mutual fund assets in a trust who passes away mid-year might benefit from a §645 election in a big way if the mutual funds paid large dividends in December after death, but the trustee was unable to distribute those mutual funds before the end of the year. In that case, the trust could have a significant amount of capital gain income in the year. The capital gain income could easily exceed the threshold at which the net investment income tax would take effect, driving up the marginal tax rate.

The §645 election makes it possible to extend the trust’s fiscal year until just before the first anniversary of the grantor’s death. In that way, the trust’s distribution deduction might reduce the trust’s taxable income, possibly low enough that the net investment income tax is much smaller or disappears entirely.

The benefits of the §645 reach beyond the choice of a fiscal year

Under the mantle of “every little bit helps,” estates have a larger exemption than either simple trusts or complex trusts. While trusts can use either a $100 or $300 exemption deduction to reduce their taxable income, estates are permitted a $600 exemption deduction. While this may not be a big benefit for a trust having significant assets, it does help.

Trusts that utilize the §645 election are not required to make estimated tax payments during their first two years of existence (Treas. Reg. §1.645-1(e)(4)). When beneficiaries of a trust are grieving the loss of a family member, the §645 election makes it possible to avoid the additional pain of estimated tax payments.

Like most things tax-related, there are some downsides. Making the benefits of the §645 election available to the trust takes some work. The tax practitioner does most of it, but the trustee will have some forms to sign and put in the mail. Two situations could also result in paying more in income taxes.

The first situation arises from timing issues. By delaying the end of the fiscal year into a new calendar year, the trust and its beneficiaries will pay tax in a subsequent year. In many cases, this is a benefit for the beneficiaries. However, a beneficiary who has greater income in the next year may find that the additional income from the QRT pushes them into a higher tax bracket.

The second situation arises when the decedent has a related estate and a trust. Instead of the trust and the estate each having its own income that must be taxed on its own tax rate schedule, their incomes are combined without expanding the tax brackets. While this might not matter for larger trusts and estates that reach the highest tax bracket on their own, that highest tax bracket is set low enough that it does not take much income to reach it. For 2021, taxable incomes of just $13,051 reach the highest tax bracket.

The first step that a tax practitioner should take if they think a trust may benefit from the election is to review the trust instrument in light of IRC §645 to ensure that the trust can qualify as a QRT. If this test is passed, a discussion with the trustee would be in order. This discussion is a key opportunity to confirm their willingness to make the §645 election. The trustee should go on record to confirm the change of tax year is acceptable to the beneficiaries.

Even if the trust is on board with the §645 election, filing an extension might be a good idea. Although this step is not required, this gives the practitioner and the trustee more time to collect information and choose the fiscal year for the §645 election.

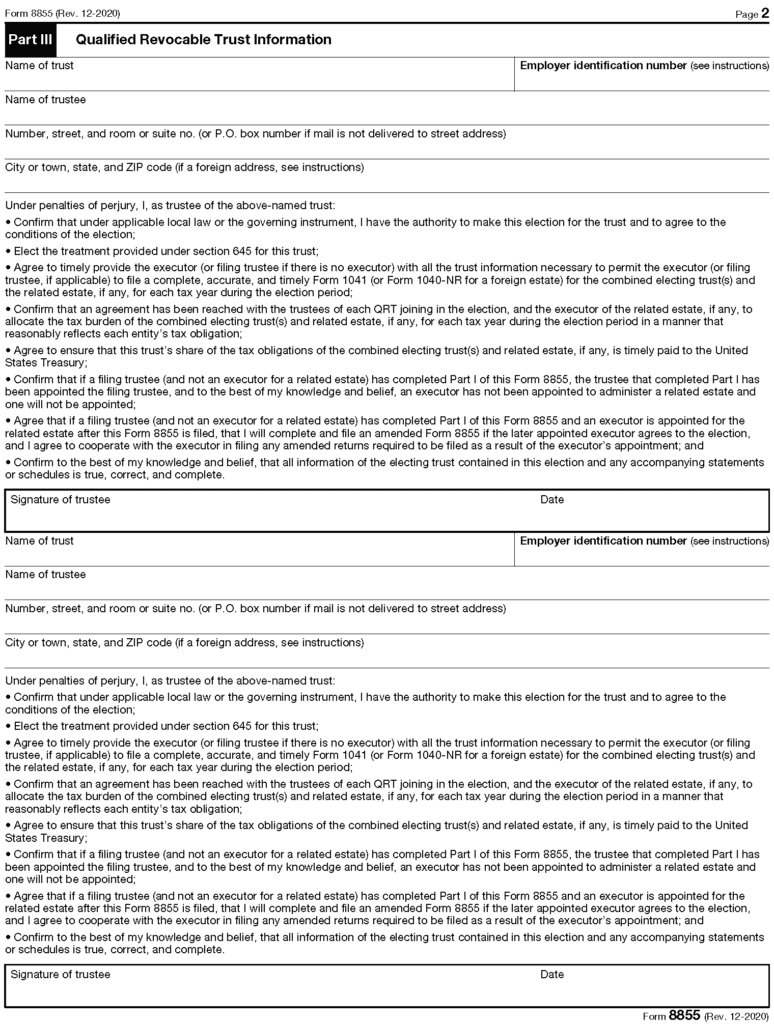

The §645 election itself is made by filing IRS Form 8855, Election To Treat a Qualified Revocable Trust as Part of an Estate. This form identifies the QRT making the election, associating it with any related estate, and identifying the taxpayer who died with their date of passing. The trustee must sign this form and know that the election is irrevocable. The executor of any related estate must also sign the form. This form must be paper-filed with either the IRS office in Kansas City, Missouri, or the IRS office in Ogden, Utah. Pages 1 and 2 of Form 8855 follow.

Preparing the trust return may take some additional effort compared with a calendar year trust return

For a fiscal year return, relying on just the 1099 information returns is not an option. Additional work is required to determine the income the trust earned after the calendar year ended, but the tax year is still open. This income must be placed on the Form 1041 return of a trust making the §645 election and choosing a fiscal year. The Form 1041 return itself should be marked as “Decedent’s Estate” in Box A, even though it is technically a trust, as shown below.

The §645 election temporarily turns the trust into an estate for tax purposes. Even though this election has a limited life, two years in most cases, it can benefit trusts, their beneficiaries, and the tax practitioners who are just trying to hang on this time of year.

The first return may also be the final one in many cases. In other cases, there is a need for the trust to continue, perhaps beyond the period that IRC §645 allows it to be treated as an estate. This section of the Code and the associated regulation mentioned earlier present additional requirements with which the tax practitioner using the §645 election should be familiar.

Tax practitioners interested in more information about the §645 election for QRTs should be familiar with IRC §645 and Treas. Reg. §1.645-1. They can also check the 2020 University of Illinois Federal Tax Workbook, Volume B, Chapter 3: Trust Essentials for a more thorough discussion of this election. Tax practitioners interested in the taxation fundamentals of trusts and estates should plan to attend the Tuesday, May 24 webinar entitled Form 1041 Basics. If you’re interested and want to be notified when registration is live – sign up for email notifications.

By John W. Richmann, EA, MBA

Tax Materials Specialist, U. of I. Tax School

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.