Meet Catherine Riddick, Tax School Instructor

This week we’re continuing our summer series on introducing you to the 2024 Fall Tax School instructors. The top quality of our instructors has always been one of Tax School’s…

July 29th, 2024

2026 is just around the corner! We all knew it was coming, but now that it’s almost here, the pressure to use the increased lifetime estate and gift tax exemption is mounting. We will discuss this reality and how to plan for the decreasing exemption in the upcoming webinar presented by the University of Illinois Tax School on August 6, 2024.

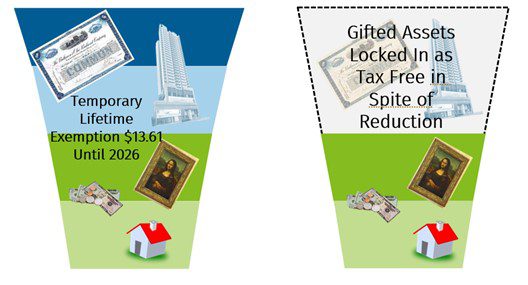

Estate tax applies when a taxpayer’s total gifts and transfers at death exceed the lifetime exemption. Historically, the exemption was relatively low—think back to the $675,000 exemption in the 1990s. Starting in 2011, taxpayers started enjoying the much larger $5 million exemption which increased each year with inflation. Then, in 2017, the Tax Cuts and Jobs Act made an unprecedented move by temporarily doubling the exemption to $10 million. With inflationary adjustments, the exemption currently stands at $13.61 million for gifts or inheritances transferred in 2024. Under IRC §2010(c)(3), the basic exclusion amount automatically returns to its $5 million threshold in 2026. Analysts estimate the inflation-adjusted exemption will be approximately $7 million per taxpayer in 2026 after the sunset.

Taxpayers can lock in the larger exemption by making lifetime transfers up to the $13.61 million exemption threshold before the 2026 sunset. Treasury Regulation 20.2010-1 effectively grandfathers these transfers for taxpayers dying after 2025. Locking in the exemption requires taxpayers to effectively divest themselves of their assets. Transfers can be made as outright gifts, but, as discussed in the upcoming webinar, taxpayers can maximize their tax-saving opportunities by utilizing discounting, family partnerships, and trusts.

One of the most widely discussed planning opportunities leading up to the sunset is the Spousal Lifetime Access Trust (SLAT). A SLAT is simply a lifetime irrevocable credit shelter trust designed to use the temporarily increased exemption before 2026. SLATs are particularly popular for couples with assets ranging from $20 -$50 million. The underlying concept of a SLAT is that if a couple owns $20 million, they both could gift away $10 million each and lock in their larger exemption amount. Doing so would leave them penniless. However, not gifting before 2026 exposes roughly $6 million of their assets to estate tax resulting in an estate tax bill of $2.4 million. In order to “have their cake and eat it too,” couples may consider creating SLATs. In theory, Spouse 1 would create an irrevocable trust naming Spouse 2 and the lifetime beneficiary and Spouse 2 would create an irrevocable trust naming Spouse 1 as the beneficiary. After the creation of the trusts, each spouse can now live off the assets held in trust for their benefit.

Couples creating SLATs for one another must consider the Reciprocal Trust Doctrine described in Lehman v. Commissioner, 109 F.2d 99 (2d Cir. 1940) and later refined in United States v. Grace, 395 U.S. 316 (1969). If trusts appear to have been created in a quid pro quo arrangement, the IRS will disregard the transactions leaving the trusts subject to estate tax at the death of the grantor. While no safe-harbor standards exist to confidently avoid the reciprocal trust doctrine, practitioners should evaluate factors including timing, distribution standards, beneficiaries, withdrawal rights, powers of appointment, assets, and choice of fiduciaries.

SLATs are only one tool in the estate planning toolbelt. Practitioners must consider the use of family partnerships, grantor retained interest trusts, qualified personal residence trusts, and traditional gifting when analyzing how clients can best use the available increased exemption before it disappears. There is no one-size-fits-all as each family has unique goals and assets that take time to understand, discuss, and analyze.

Employing advanced planning techniques requires careful analysis and skillful drafting since the IRS will be scrutinizing these transfers. Taxpayers retaining too much control over family partnerships or receiving ongoing benefits from trust shells may require including the entire trust in the taxpayer’s gross taxable estate at death. These adverse consequences usually won’t be known until the taxpayer’s death at which point tax mitigation opportunities will be obsolete. Practitioners should begin having robust conversations now with clients to ensure the opportunity to utilize the increased exemption isn’t lost forever.

By Klaralee R. Charlton

J.D., L.L.M.

Learn more about this topic from Klaralee Charlton at the August 6 webinar.

Stay up-to-date!

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.

Join 2,200 of your colleagues and get notified each time a new post is added.