The One Big Beautiful Bill Act (OBBBA), Public Law 119-21, 139 Stat. 72 (July 4, 2025), created a federal income tax deduction for “qualified overtime compensation” received during the year. The deduction is limited to $12,500 ($25,000 in the case of a joint return), and it is in effect for tax years 2025-2028. Qualified overtime compensation is overtime pay required under the Fair Labor Standards Act (FLSA). This deduction begins to phase out for those with MAGI above $150,000 ($300,000 MFJ). Qualified overtime must be reported separately on a W-2 or a 1099 (if the taxpayer is not an employee), and a social security number must be included on the tax return.

Last fall, IRS issued Notice 2025-62 explaining employers’ modified reporting obligations for the 2025 tax year and Notice 2025-69 providing guidance to employees who received overtime compensation in the 2025 tax year. On January 23, 2025, the IRS issued FAQs to pull the guidance together and clarify outstanding questions related to this new deduction. Here we outline the key requirements for taking this deduction on 2025 returns.

What is Qualified Overtime Compensation?

The deduction is only available for “qualified overtime compensation.” This is defined as:

- Overtime required to be paid under section 7 of the Fair Labor Standards Act (FLSA)

- Overtime paid to a person for work that is not exempt from the FLSA overtime requirement

- Only the premium portion of the overtime compensation

- The standard overtime pay rate is 1.5 times the regular rate of pay. The deductible “qualified overtime compensation” is limited to the “one-half portion” of the standard rate

Overtime pay is not deductible if the overtime compensation received by an individual is not required by the FLSA. Ineligibility for the deduction can occur in multiple circumstances. For example, the following types of overtime pay is not qualified overtime compensation:

- Overtime pay required by a collective bargaining agreement, but not the FLSA

- Overtime pay required by State law, but not the FLSA

- Overtime pay for work that is exempt from FLSA overtime pay requirements (agricultural work is generally exempt from FLSA requirements)

- Overtime compensation paid in excess of the qualified overtime compensation

- For example, If the employer pays two times the regular pay rate during holidays, the qualified overtime compensation is limited to the one-half portion of the regular pay rate.

Determining FLSA Coverage

The FAQs address the issue of how employees can determine whether they are covered by FLSA or if their work is exempt. IRS states that although it is common for employees to be covered by the FLSA, there are many exemptions from its overtime premium requirement. The FAQ states that “whether an individual is covered by and not exempt under the FLSA is a fact-specific determination that depends on the individual’s occupation, work activities, and/or earnings.”

The IRS points employers and employees to the Department of Labor website, specifically Fact Sheet #14: Coverage Under the Fair Labor Standards Act (FLSA) | U.S. Department of Labor, and # 8 in the Handy Reference Guide to the Fair Labor Standards Act.

The IRS states that federal employees’ eligibility is typically documented on the employee’s Standard Form 50, Notification of Personnel Action; see block 35 “FLSA Category”. “E” means exempt or FLSA-ineligible and “N” means nonexempt or FLSA overtime-eligible. Under 29 U.S.C. § 204(f), the Office of Personnel Management (OPM) administers the FLSA for most federal employees. See OPM FLSA regulations and OPM FLSA fact sheet.

Deduction Limits

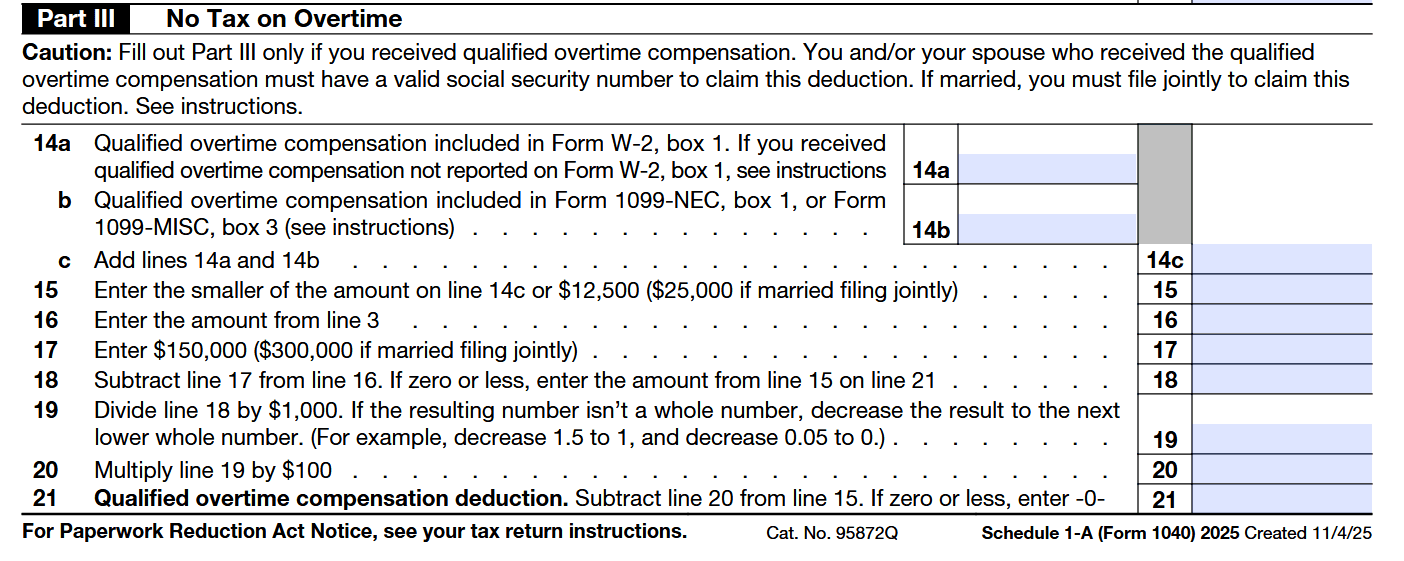

The FAQ restates the limits on the deduction. Employees can deduct up to $12,500 of qualified overtime compensation earned for the year per return ($25,000 in the case of a joint return). The deduction is reduced if a taxpayer’s modified adjusted gross income (MAGI) for the tax year exceeds $150,000 ($300,000 for joint filers). To claim the deduction, the taxpayer must include a Social Security number. If they are married, they must file a joint return.

Reporting Requirements

The FAQs also summarize the guidance provided by earlier IRS Notices regarding how employers are required to report overtime compensation and how employees may calculate their deductions. The rules differ between 2025 and 2026 tax years because of special reporting exceptions granted for the 2025 tax year.

For tax year 2025, employers and other payers are not required to report qualified overtime compensation separately on Forms W-2, 1099-NEC, and 1099-MISC. They may choose to separately report the qualified overtime compensation to employees using box 14 of Form W-2 or through an online portal or on a separate statement.

If employees do not receive a Form W-2 or other statement from their employer for tax year 2025 that separately reports the amount of qualified overtime compensation, they may use any of the methods described in Notice 2025-69 and the Instructions to Form 1040, Schedule 1-A (see pages 105 to 108) to calculate the amount of qualified overtime compensation. Generally, this requires isolating all overtime payments made and dividing the total by three to determine the overtime premium. This is the qualified overtime compensation.

For tax years after 2025, employers and other payers will be required to separately report qualified overtime compensation on updated forms.

To claim the deduction, taxpayers report their qualified overtime compensation on the new Form 1040, Schedule 1-A.

Related Tax School post (original content):

OBBBA Update: Qualified Tips and Overtime Compensation for Tax Year 2025

Original article published January 29, 2026. Reprinted here with permission.

By Kristine Tidgren, JD

Director, Center for Agricultural Law & Taxation

Adjunct Assistant Professor, Agricultural Education

Iowa State University

Sources:

- Relief from Certain Penalties Related to Information Reporting Required in Connection with No Tax on Tips and Overtime | Internal Revenue Service

- Guidance for Individual Taxpayers who received Qualified Tips or Qualified Overtime Compensation in 2025 | Internal Revenue Service

- Fact Sheet #56A: Overview of the Regular Rate of Pay Under the Fair Labor Standards Act (FLSA) | U.S. Department of Labor

- Questions and answers about the new deduction for qualified overtime compensation | Internal Revenue Service

- Fact Sheet #14: Coverage Under the Fair Labor Standards Act (FLSA) | U.S. Department of Labor

- Handy Reference Guide to the Fair Labor Standards Act | U.S. Department of Labor

- Code of Federal Regulations, Title 5 | Electronic Code of Federal Regulations (eCFR)

- How to Compute FLSA Overtime Pay | U.S. Office of Personnel Management

- 1040 (and 1040-SR) | Internal Revenue Service

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.