Penalties are based on the amount and timing of the underpayment. The IRS may also charge interest on the penalty itself. The IRS publishes interest rates quarterly.

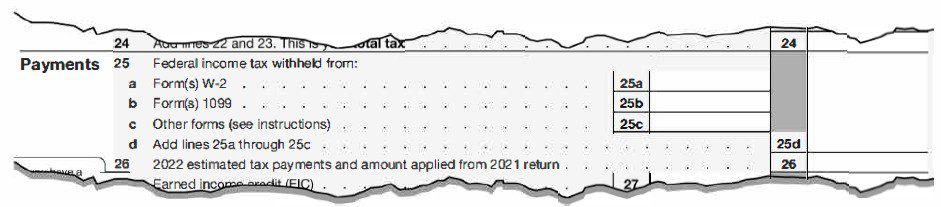

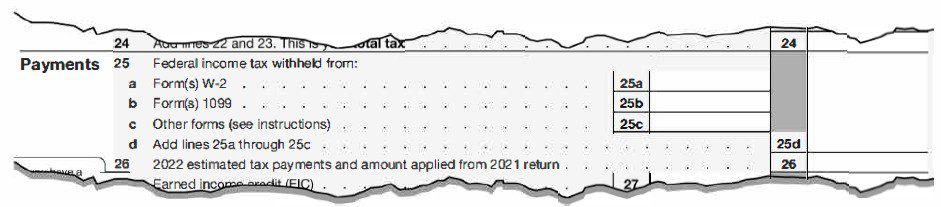

Taxpayers can avoid penalties by making appropriate and timely payments. Withholding from Forms W-2, 1099s, and other forms applicable to line 25c of the Form 1040 is considered to have been paid one-fourth on each payment due date.

There are limited circumstances in which the IRS may remove or reduce a penalty. The follow are some circumstances where the IRS would consider abating a penalty.

There are limited circumstances in which the IRS may remove or reduce a penalty. The follow are some circumstances where the IRS would consider abating a penalty.

- The taxpayer, or their spouse if married filing jointly (MFJ), retired in the previous two years after turning age 62 or became disabled, and have reasonable cause for underpaying the estimated tax or paying late.

- Most of the taxpayer’s income tax was withheld early in the year instead of spread evenly throughout the year.

- The taxpayer’s income varies during the year.

Figuring the Penalty

Generally, the IRS figures any underpayment penalties and sends a bill to the taxpayer. However, taxpayers must compute their penalty for any of the following reasons.

- The taxpayer is requesting a waiver of part of their penalty.

- The taxpayer’s income varied throughout the year and their penalty is reduced or eliminated when applying the annualized income installment method (explained later).

- The taxpayer’s penalty is lower when treating the federal income tax withheld from their income as paid on the dates it was actually withheld, rather than in equal amounts on the payment due dates.

Taxpayers who file their return by the due date of the Form 1040, without extension, are not charged interest on the penalty if they pay the penalty by the date shown on the bill. If taxpayers would rather have the IRS figure the penalty, they should not file Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, and leave the penalty line on their return blank.

The required installment deficiencies are calculated using a daily penalty rate based on the number of days the balance is due, resulting in the net underpayment penalty. Taxpayers calculate the number of days their installment payment is delinquent and apply the applicable penalty rate of between 4% and 7%. The Worksheet for Form 2210, Part III, Section B – Figure the Penalty (Penalty Worksheet) guides taxpayers in calculating their quarterly penalties.

Methods for calculating the estimated tax penalty

There are two acceptable methods for calculating the estimated tax penalty: the regular method and the annualized income installment method.

Regular Method

Under the regular method, taxpayers must pay 25% of their required annual payment on each of the four installment payment due dates. If the taxpayer’s estimated taxes and withholdings are equal to or more than their required annual payments for all payment periods, they do not owe a penalty. The withholding may consist of any prior year overpayments, specific payments, and withholdings. A taxpayer does not need to file a Form 2210 if their withholdings and estimated taxes exceed their required annual payment.

Annualized Income Installment Method

For taxpayers with inconsistent yearly earnings (such as portfolio income, bonuses, capital dispositions, or seasonal business income), equal quarterly payments may not be sufficient to reduce or eliminate the underpayment penalty. Taxpayers who do not receive income evenly throughout the year are allowed to use the annualized income installment method to reflect the income earned in the period immediately before the installment due date. The annualized income installment method may result in estimated tax payments which differ from the traditional equal installments in an attempt to match prepayments to earnings.

Taxpayers using the annualized income installment method figure the required installments to enter on Form 2210 on Schedule AI, Annualized Income Installment Method. Schedule AI modifies a taxpayer’s AGI and uses the annualization amounts to reflect the periods in which the income was earned. If a taxpayer uses Schedule Al for any payment due date, they must use it for all payment due dates. A taxpayer using the annualized income installment method must complete all the following steps.

- Compute annualized income on part I of Schedule AI and part II if the taxpayer has SE income

- Figure the penalty on part III of Form 2210

- Select box C on part II of Form 2210, reflecting the taxpayer is using the annualized income installment method

- Calculate income and deductions based on the taxpayer’s method of accounting for each period on Schedule Al (cash method taxpayers must include all their income actually or constructively received and all deductions actually paid during the period)

- Attach all parts of Form 2210 and Schedule AI to the taxpayer’s return

This article is a reprint from the 2023 University of Illinois Federal Tax Workbook, Chapter 9: Individual Taxpayer Issues.

The upcoming June 3 webinar, Getting Rid of Penalties, will also cover this topic.

Sources

- Underpayment of Estimated Tax by Individuals Penalty. May 16, 2023. IRS. [www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty] Accessed on Jun. 8, 2023.

- For current year interest rates, see Quarterly Interest Rates. May l, 2023. IRS. [ www.irs.gov/payments/quarterly-interest-rates] Accessed on Jun. 9, 2023.

- Instructions for Form 2210.

- Underpayment of Estimated Tax by Individuals Penalty. May 16, 2023. IRS. [www.irs.gov/payments/underpayment-of-estirnated-tax-byindividuals-penalty] Accessed on Jun. 8, 2023.

- IRC §6654(d)(2) and Instructions for Form 2210.

- See Instructions for Form 2210.

There are limited circumstances in which the IRS may remove or reduce a penalty. The follow are some circumstances where the IRS would consider abating a penalty.

There are limited circumstances in which the IRS may remove or reduce a penalty. The follow are some circumstances where the IRS would consider abating a penalty.