COVID-19 made tax client representation difficult. It wasn’t easy to contact the IRS, even though practitioners had access to the IRS’s Practitioner Priority Service phone line. As many IRS employees worked from home, submitting a tax information authorization or a power of attorney became difficult.

However, they still received Forms 2848, Power of Attorney, or 8821, Tax Information Authorization, at their offices, where fax machines ran out of paper, toner, or both. This cumbersome process required tax practitioners to expend additional time and resources to serve their clients adequately, whether representing them in an active controversy or ensuring that tax returns were complete.

Fortunately, in August 2023, the IRS unveiled a new feature for Tax Pro accounts: the ability to link these accounts to the tax practitioner’s centralized authorization file (CAF) records. This link enables the tax practitioner to view the clients for whom they have authorizations in effect and lets them manage the authorizations. For example, they can immediately withdraw a power of attorney for a client they no longer represent. Tax professionals can access their tax pro accounts at www.irs.gov/tax-professionals/tax-pro-account.

Previously, tax practitioners had to file a Freedom of Information Act (FOIA) request to manage their active client authorizations, usually requiring a several months’ turnaround time. Receipt of a copy of a former client’s IRS correspondence during the turnaround might require the tax practitioner to make an awkward phone call to discuss a tax matter.

When the link between their Tax Pro accounts and their CAF files is in place, the tax practitioner can withdraw a power of attorney or tax information authorization immediately. No longer must an IRS employee at one of three CAF units pick up Form 2848 or 8821 containing withdrawal information. Instead, a tax practitioner need only select a few checkboxes in the appropriate screens, and the relationship no longer exists in the tax practitioner’s CAF record. In essence, the IRS has automated much of the requirements of Internal Revenue Manual section 21.3.7, Processing Third-Party Authorizations onto the Centralized Authorization File.

With the new process, tax pro accounts facilitate the entire life cycle of a representation engagement, from requesting a client’s authorization at the beginning of an engagement, to getting information during an engagement, to terminating access to IRS records when the engagement terminates. If bankers, mortgage brokers, and other financial professionals routinely require access to IRS documents, why should tax professionals not routinely obtain these documents?

This blog shows tax practitioners how to link tax pro accounts to CAF database records. After establishing the link, the tax practitioner should be able to provide better representation or tax preparation services in less time.

This discussion focuses on two steps. Step 1 confirms the tax practitioner’s identity in their Tax Pro account. The IRS then mails a personal identification number (PIN) to the tax practitioner. When Step 2 is successful, the practitioner’s Tax Pro account is linked to their CAF account, enabling them to view active authorizations.

Step 1 — Apply for a PIN

Applying for a PIN is how the IRS verifies the identity of the tax practitioner. Its method for securely verifying the practitioner’s identity involves sending the PIN to the tax practitioner’s address in their CAF database record. Normally, this is the address to which the IRS sends the practitioner’s copy of notices to the client.

Because multiple IRS systems are involved, tax practitioners must navigate several screens that challenge them to verify their identity. The first screen consists of logging into their tax pro accounts using ID.me. This screen probably looks familiar because tax practitioners see it when requesting a transcript with the transcript delivery system.

Currently, the IRS’s website presents an information box informing tax practitioners about a new system that allows them to view all authorizations and withdraw any of them online, as shown below in Figure 1.

Figure 1

Log Into Your Tax Pro Account

Linking a tax practitioner’s tax pro account to their CAF record requires the practitioner to have a tax pro account. Early in the process, they can create their tax pro account if they do not have one already. One of our 2021 blogs explained how to do this.

Before pressing the green “Sign in with ID.me” button, the tax practitioner should have their 9-digit CAF number handy. They should also expect to use the 2-factor authentication code generator, so having one’s cell phone nearby may be helpful.

Next, a welcome screen appears, the same one where a licensed practitioner can initiate a request to a client for a Power of Attorney (POA) or a Tax Information Authorization (TIA).

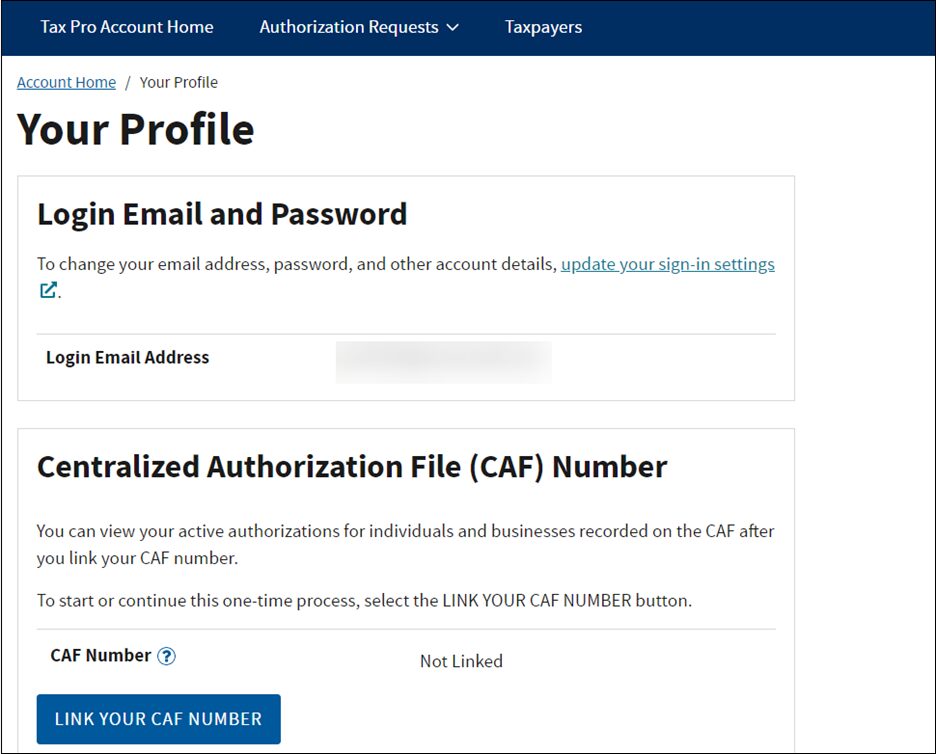

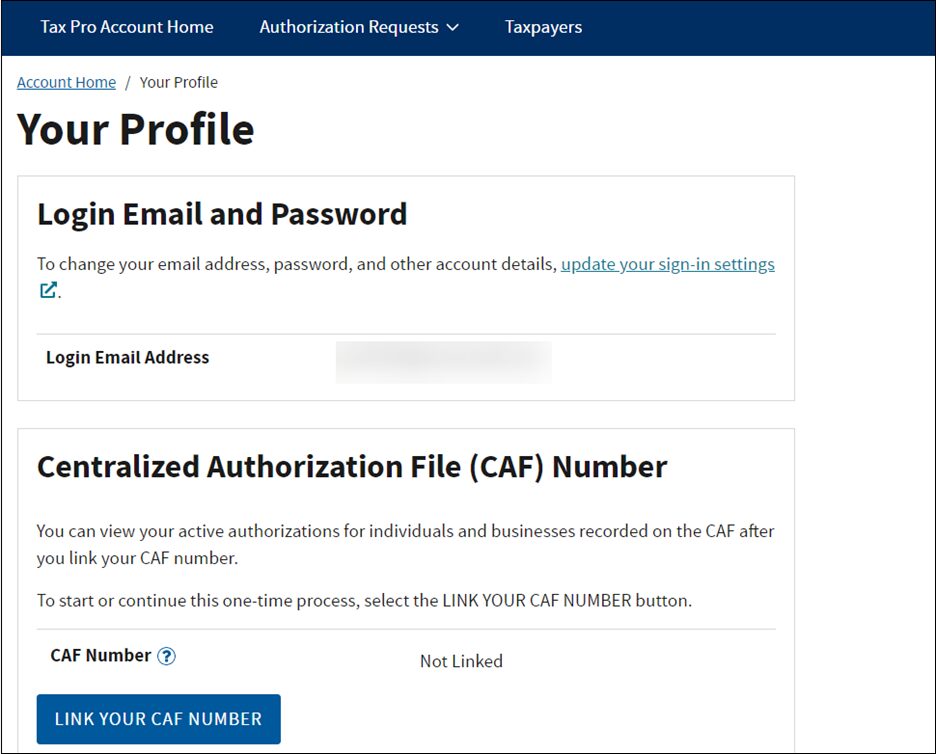

Your Profile

This screen directs the tax practitioner to access their account profile by clicking the link. A blue “LINK YOUR CAF NUMBER” button opens when the account profile opens (Figure 2).

Figure 2

Until the IRS’s systems recognize the link between the CAF number and the tax pro account, the status appears as “Not Linked.”

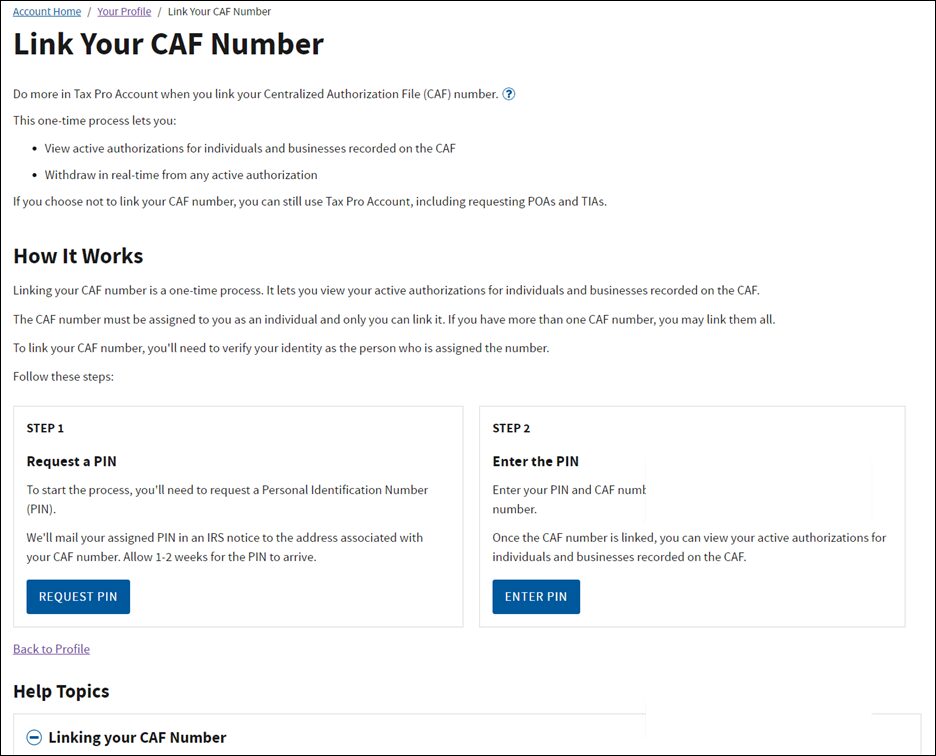

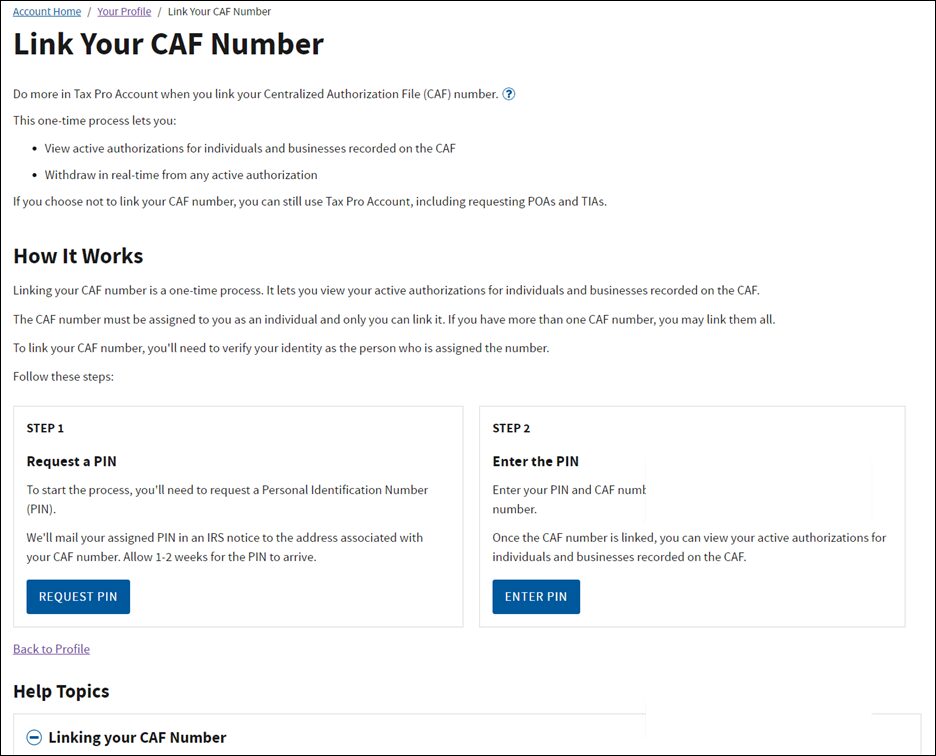

Link Your CAF Number

Pressing this button begins the linking process, opening the following window (Figure 3) containing instructions.

Figure 3

This screen enables the tax practitioner to request a PIN, which the IRS sends through the U.S. Postal Service. It advises that it may take 1 – 2 weeks to arrive. This range is an accurate estimate in my experience, as my PIN required about eight days to arrive at the post office box that I use for IRS correspondence.

Enter Your CAF Number

Pressing the blue “REQUEST PIN” button opens another screen labeled “Request a PIN,” in which the tax practitioner enters their CAF number and selects whether they wish the IRS to send them their notice in English or Spanish.

Request a PIN

Upon pressing the blue “REQUEST PIN” button, another screen opens to confirm that the PIN request was received and repeats the caution that one or two weeks are needed for the IRS response to arrive. The tax practitioner has verified their identity and must wait for the CP310 notice with their PIN.

Step 2 — Enter the PIN and Finish the Linking Process

The wait may seem unnecessary to some, as it makes the PIN authentication process dependent on an external system with a reputation for highly variable delivery times. However, this amounts to another 2-factor authentication system with security overseen by the U.S. Postal Service. This seems like a reasonable delay because of the sensitivity of taxpayer information available to tax practitioners.

It’s a good idea to complete the process as soon as the postal service delivers the CP310 notice containing the PIN. This number is good for only 30 days, and if, for some reason, the PIN becomes invalid, the tax practitioner must repeat the process described above under Step 1 to request a new PIN.

Entering the PIN

The CP310 notice arrives with a heading advising, “We assigned you a Personal Identification Number (PIN).” In my case, the PIN had eight digits, although the screen for entering the PIN states that it contains 4 to 8 digits. After entering the PIN, the tax practitioner must again enter their CAF number.

Success!

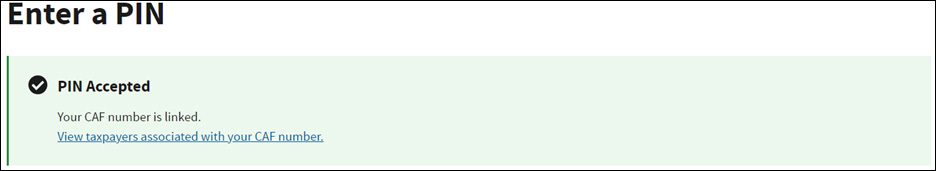

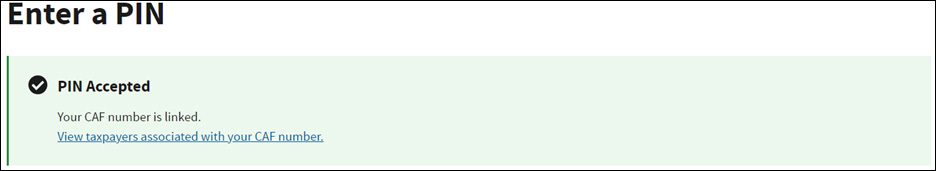

After successfully entering their PIN, another dialog box appears, similar to Figure 4.

Figure 4

This screen confirms that the tax practitioner has verified their identity and successfully linked their CAF number to their tax pro account. As if to extend a right hand for congratulations, a link enables the tax practitioner to view all taxpayers currently associated with their CAF number.

Conclusion

It appears now that the IRS’s work to link CAF numbers to tax pro accounts is a significant accomplishment, allowing tax practitioners to manage their authorizations much more efficiently.

By John W. Richmann, EA, MBA

Tax Materials Specialist, U of I Tax School