In an effort to answer your more pressing questions regarding ERC, I am offering information which was presented during our 2021 Fall Tax School as well as our topic specific webinar. Do you think the below facts are true or false?

Fact 1: The ERC is available for the second, third, and fourth quarters of 2020, even if a taxpayer received a PPP loan during 2020.

True as of December 27, 2020. Takeaway: While true, the same payroll used to qualify PPP loans for forgiveness may not be used for ERC purposes. No double dipping.

Fact 2: 2020 payroll returns need to be amended for 2020 ERC results since the law was not clarified until December of 2020. In addition, taxpayers must amend and reduce 2020 payroll expenses claimed on filed 2020 returns, even though ERC credits have not yet been received.

True. Takeaway: When the taxpayer finally receives their ERC credit for 2020, it will not represent taxable income. Additional takeaway: do not change taxpayer’s issued W-2’s for ERC credit claimed.

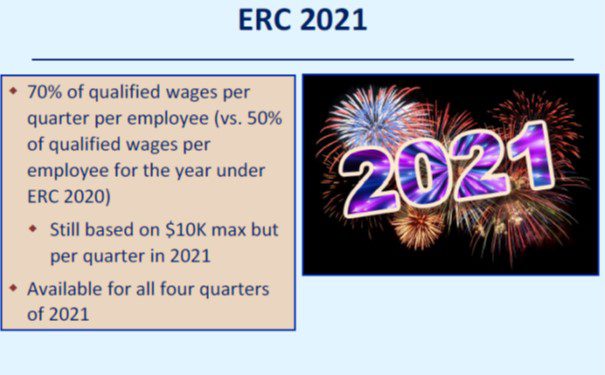

Fact 3: ERC for 2021 is available for all four quarters of 2021.

It was true as originally enacted but the Infrastructure, Investment and Jobs Act (IIJA), signed by President Biden on November 15, 2021, eliminated the ERC for the fourth quarter of 2021 unless the business meets the definition of a Recovery Start-Up Business. Takeaway: Taxpayers who anticipated ERC for the fourth quarter 2021 may need to catch up their payroll tax deposits, or face potential underpayment penalties as described in IRS Notice 2021-65.

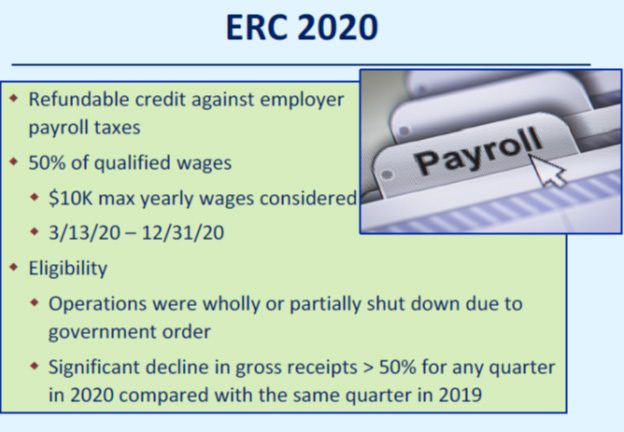

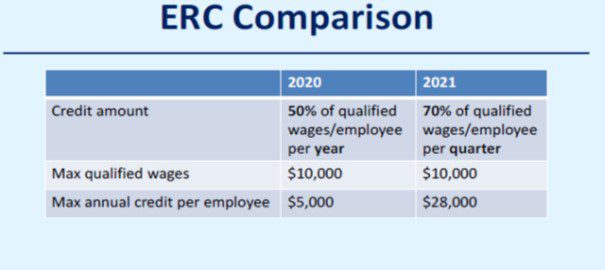

Fact 4: The ERC credits for 2020 and 2021 are the same.

False. The amount of credit, size of business and qualifying “event” circumstances are different for each year.

Note: The third point above is no longer true thanks to the IIJA as discussed; ERC is only available for the first three quarters in 2021.

Note: The $28,000 in the above chart should be reduced to $21,000 since the IIJA eliminated the ERC for the fourth quarter of 2021 except for Recovery Start-Up Businesses.

Fact 5: Related party rules for determining qualifying wages for ERC purposes are as complicated as landing an astronaut on Mars. Answer: True. Takeaway: I’m attaching examples and text excerpted from our 2021 University of Illinois Federal Tax Workbook, Volume B, Chapter 6, Small Business Issues. Review our examples and “plug-in” your own client’s information to help better explain this complicated area.

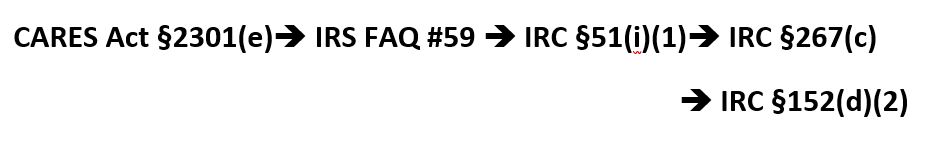

Qualified Wages for Related Parties. Wages paid to parties related to a greater than 50% owner do not qualify for the ERC. The CARES Act refers to IRC §§51(i)(1) and 280C(a) for the definition of qualified wages. IRC §51(i)(1)(A) attempts to define related parties by referencing IRC §§152(d)(2)(A) through (G) to define applicable relationships to the taxpayer.

-

-

-

- A child or a descendant of a child

- A brother, sister, stepbrother, or stepsister

- The father or mother or an ancestor of either

- A stepfather or stepmother

- A son or daughter of a brother or sister of the taxpayer

- A brother or sister of the father or mother of the taxpayer

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

-

-

The wages of employees who have a previously listed relationship to the business owner (greater than 50% owner) are not qualified wages for ERC purposes.

The IRS states that the definition of a greater than 50% owner includes individuals who directly or indirectly own greater than a 50% interest in a business.

The term “directly or indirectly” in §51(i)(1)((A) is “determined with the application of section 267(c)…” Under the family attribution rules of IRC §267(c)(4), members of the family include brothers and sisters (whole or half-blood), spouse, ancestors, and lineal descendants.

In addition to this family attribution rule, §267(c) also includes entity-to-member attribution, partner-to-partner attribution, and limits on reattribution. The attribution of ownership occurs regardless of whether the family member has any ownership interest in the business.

The rules under §267 apply to determine a greater than 50% owner for ERC purposes and can create many indirect owners because of their relationship to direct owners. The rules of attribution, in essence, create a “back door” disqualification of the wages of a greater than 50% owner.

Example 1. George is a 100% sole shareholder of Apex Travel, Inc., an S corporation. Apex Travel also employs George’s son, Alex. Alex’s wages do not qualify for ERC because he is related to George. However, nothing stated explicitly in the Code prevents George’s wages from being considered qualified wages for ERC purposes. When attribution rules under §267(c)(1) are considered, two owners can own more than 50% of the business either directly or indirectly. Alex is considered to own Apex indirectly by being George’s son, and George by directly owning greater than 50% of the business. Neither George’s nor Alex’s wages may be considered eligible for the ERC.

Example 2. John and Mary (siblings) are shareholders/employees in an S corporation with William, who is not related. All three owners are roughly equal in their ownership (John owns 34%). The attribution rules apply to John and Mary, which gives them a total of 67% ownership (34% + 33%), and therefore none of their wages are eligible for ERC. William’s wages will qualify for ERC since he owns 33% of the stock, less than 50%.

Example 3. Meg and Marty are cousins. They each own 50% of the stock of their S corporation. They are the only employees of their corporation. Cousins are not a relationship under the family attribution rules. Therefore, because neither Meg nor Marty own greater than 50% of the stock of their S corporation, their wages are qualified wages for ERC purposes.

Example 4. Use the same facts as in Example 3, except Meg and Marty employ their grandmother, Marge. Family attribution rules apply to ancestors. Because of this relationship, Marge is considered a 100% owner of the S corporation because of her ancestral relationship to the two 50% owners, Meg and Marty. The relationship causes the wages of all three to be ineligible for ERC.

When asking the question “Does a related party have qualified wages for ERC?” finding substantial authority can be somewhat difficult, as the authorities iteratively refer back to other sources. The following diagram will help visualize the relationship between the sources on this issue.

On August 4, 2021, the IRS issued Notice 2021-49. The notice was designed to provide clarification to issues which arose from Notice 2021-2031 and Notice 2021-23. Regarding related parties, the notice provides guidance about spouses employed by the same employer.

In particular, the notice concludes that spouses who have no other living familial relationships (other than to each other) are not related parties for the purposes of ERC qualified wages.

The following examples are adapted from the notice.

Example 5. The Mills Corporation is owned 100% by Tom Jones, an individual. The corporation is an eligible employer for ERC purposes for the first calendar quarter of 2021. Tom is married to Jerilyn, and together they have no other living family members as defined in §267(c)(4). Tom and Jerilyn are both employees of The Mills Corporation. Pursuant to the attribution rules of §267(c), Jerilyn is attributed 100% ownership of The Mills Corporation, and both Tom and Jerilyn are treated as 100% owners. However, Tom and Jerilyn do not have any of the relationships to each other described in §§152(d)(2)(A)–(H) (illustrated previously). Accordingly, wages paid by The Mills Corporation to Tom and Jerilyn in the first calendar quarter of 2021 may be treated as qualified wages if the amounts satisfy the other requirements to be treated as qualified wages.

Example 6. Use the same facts as Example 5, except Tom and Jerilyn have a son, Greg, who does not work for the same employer as Tom and Jerilyn. His existence creates as familial relationship which causes the wages The Mills Corporation paid to Tom and/or Jerilyn to not be considered qualified wages for ERC purposes.

Example 7. Little Buddies Industries, an S corporation, is solely owned by Jonas Grumby. Jonas has a son, Gilligan. Little Buddies Industries is an eligible employer for ERC for the first calendar quarter of 2021. Jonas is an employee of Little Buddies Industries, but Gilligan is not. Pursuant to the attribution rules of §267(c), Gilligan is attributed 100% ownership of Little Buddies Industries, and both Jonas and Gilligan are treated as 100% owners. Jonas has the relationship to Gilligan described in §152(d)(2)(C). Accordingly, Little Buddies Industries may not treat as qualified any wages paid to Jonas because he is a related individual for purposes of the ERC.

Thanks go out to out to the Tax School team, as well as the contributing authors and reviewers of the 2021 University of Illinois Federal Tax Workbook for their contributions to this material.

For more information:

- Consolidated Appropriations Act of 2021, PL 116-260, §§206 and 207, Employee Retention Credit. Apr. 15, 2021. IRS.

- Proc. 2021-33, 2021-34 IRB 327.

- IRS Notice 2021-20, 2011-11 IRB 922.

- IRS Notice 2021-23, 2021-16 IRB 1113.

- IRS Notice 2021-49, 2021-34 IRB 316.

- IRS Notice 2021-65

- IRC §§152(d)(2)(A)-(G).

- COVID-19-Related Employee Retention Credits: Determining Qualified Wages FAQs.

- IRC §267(b).

- Infrastructure, Investment, and Jobs Act (IIJA)

- Defining of a Recovery Startup Business

Tom O’Saben, EA.

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.