It is common knowledge that some things just can’t be done on a tax return, such as changing a filed and accepted Married Filing Jointly (MFJ) return to a Married Filing Separately (MFS) return. Indeed, Treasury Regulation §1.6013-1(a)(1) supports this position. But the language in this regulation leaves a narrow window of opportunity open that might be of interest, particularly this filing season and when specific 2021 tax credits are involved. The recovery rebates and the enhanced child tax credit stand at the top of this list.

For some years, married couples have almost always benefited from MFJ filing status. Perhaps this has been because credits such as the education and the earned income credits were unavailable to taxpayers using MFS filing status.

When and Why MFS Filing Status Might Be Preferable

Recent tax legislation, including The American Rescue Plan Act (ARPA), changes this by enhancing recovery rebates for Economic Impact Payments (EIP-3) and the child tax credit for 2021 (ARPA §9611). MFS filing status might be preferable under some circumstances because of the income levels at which the credits start to phase out. Unlike the education credits, the credits are available to taxpayers using MFS filing status. A better result using MFS filing status might happen if a married couple’s combined income is large enough to lift their modified adjusted gross income (MAGI) into the range the credits are subject to phase out.

This opportunity may not have been apparent when the first 2021 tax returns were filed. In early February, the use of filing status to qualify for larger 2021 tax credits was not on many practitioners’ radar screens, figuratively speaking.

Fortunately, early filers who used MFJ filing status and missed the larger tax credits can still receive them. They can only because the April 18 due date is still a few weeks away, and MFS filing status is still a possibility for them.

The Process for Changing from MFJ to MFS Status

The process of changing filing status involves filing superseding returns using MFS filing status. A superseding return is filed after the original return but before the return’s due date.[1] The member of the couple with less income claims the children. Tom O’Saben’s March 7, 2022, blog post on dependency clarifies this topic. For more information about filing status, see the 2021 University of Illinois Federal Tax Workbook, Volume B, Chapter 2: Individual Taxpayer Issues.

An Example

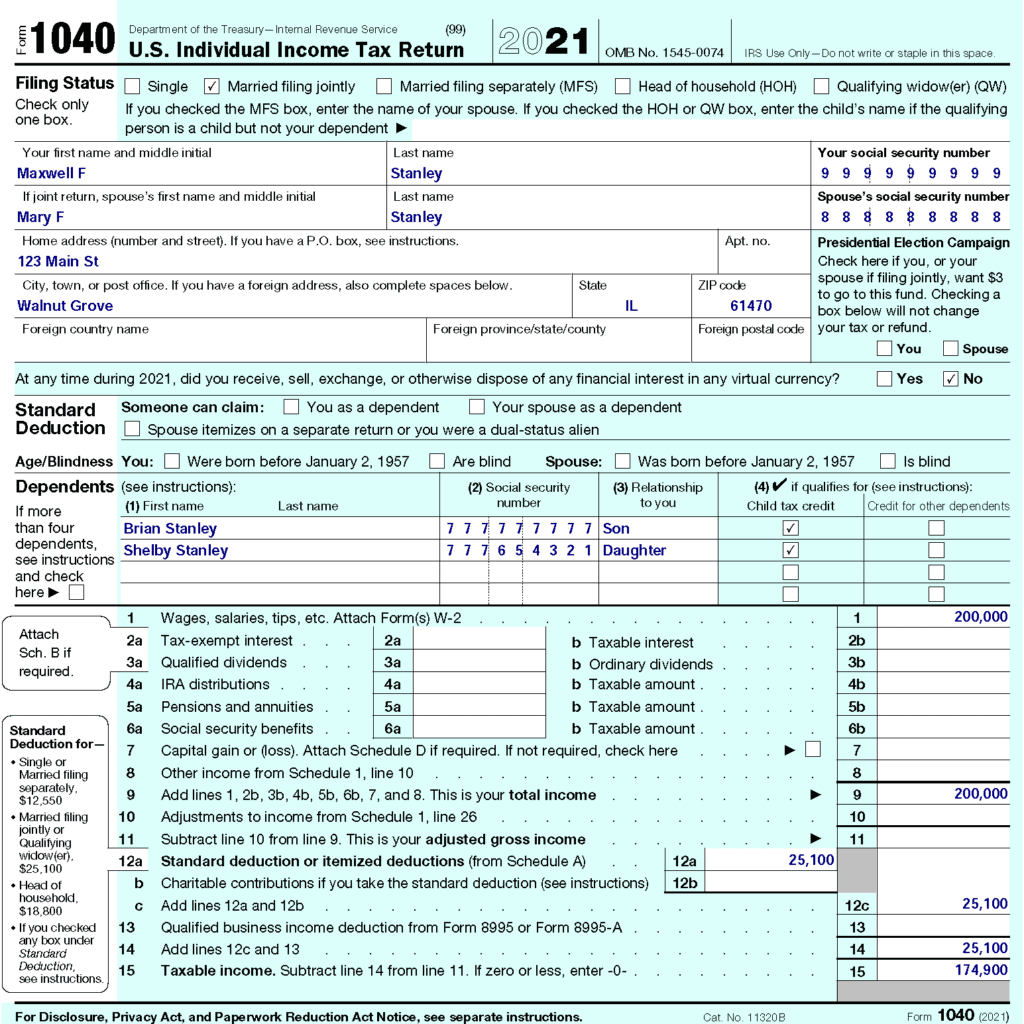

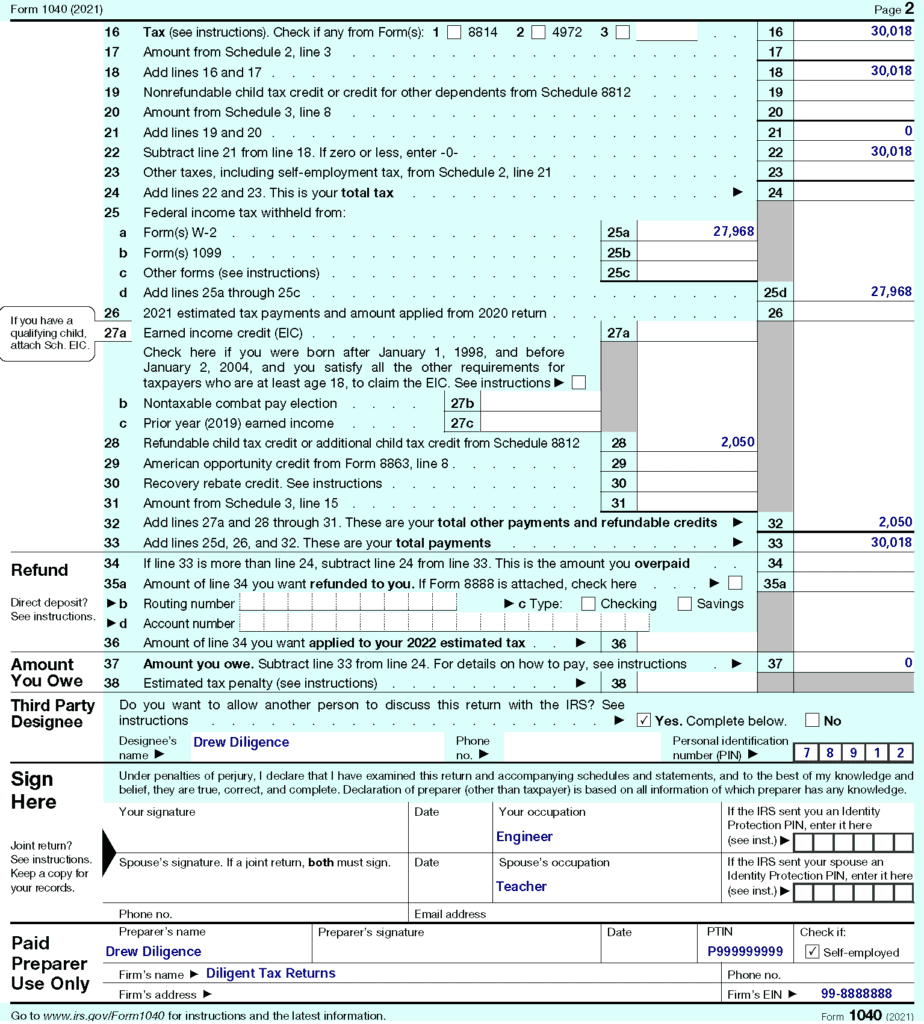

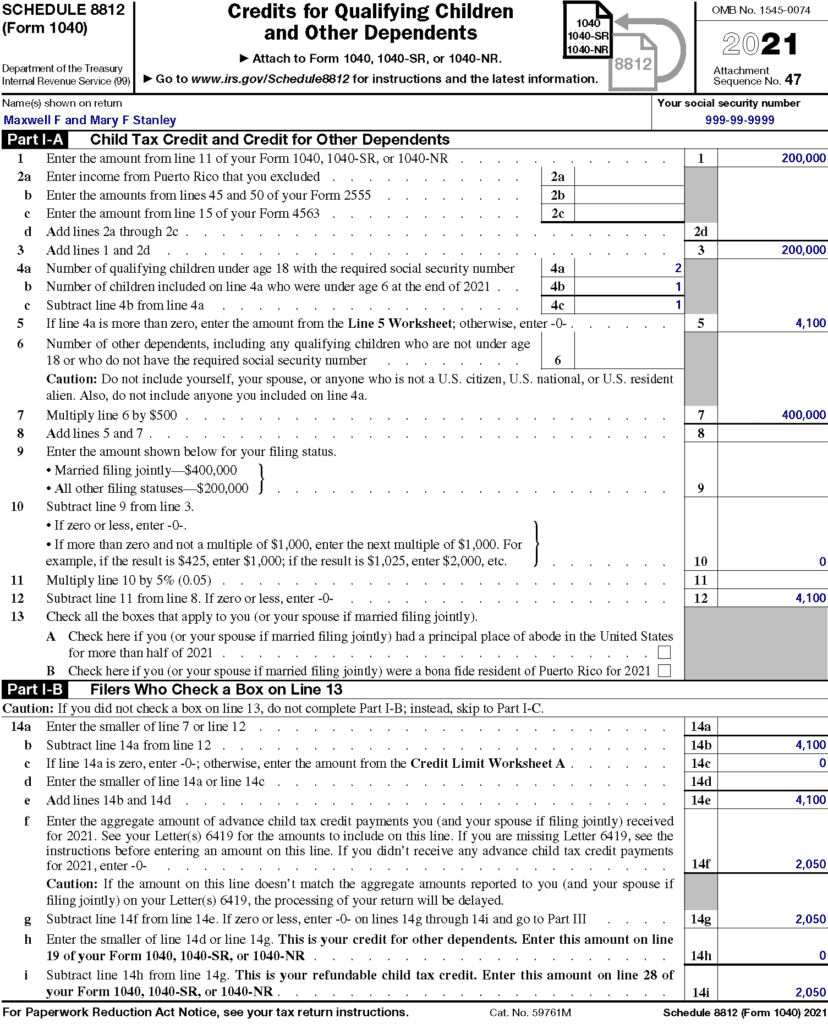

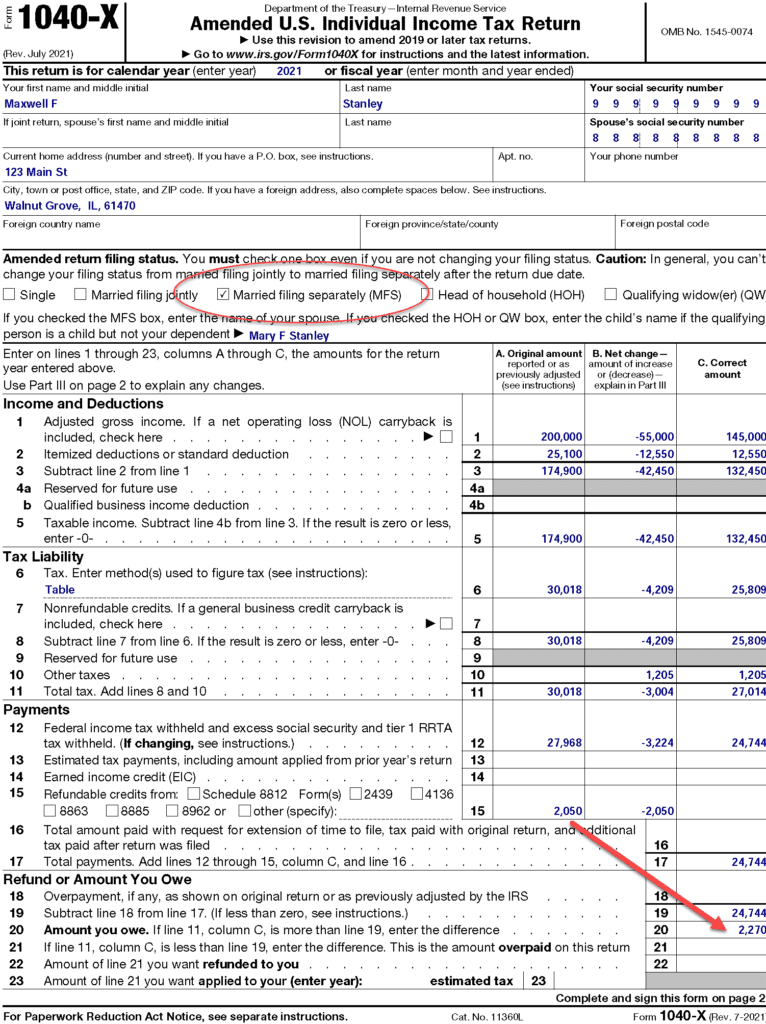

The hypothetical case of Maxwell and Mary Stanley illustrates this strategy. They have two children, ages 14 and 4. The family lives in a separate property state, like Illinois, not in a community property state, like Wisconsin or Texas. Maxwell earns $145,000, and Mary earns $55,000. Assuming they have U.S.-based jobs and no other income sources, their MAGI is $200,000. This amount is $50,000 above the lower phase-out amount for the child tax credit, entitling them to a reduced refundable child tax credit of $4,100. The maximum credits for the children, aged 14 and 4, would have been $6,600 ($3,000 + $3,600) before their joint income reduced the credit. For the advance child tax credit, Maxwell and Mary each received $1,025 in 2021, because only 50% of the reduced credit, or $2,050, was paid in advance to them. Maxwell and Mary each received half of the advance amount, or $1,025. Also, because their joint income exceeded the stimulus payment threshold, they did not receive any EIP-3 payments during 2021.

The Stanley’s originally filed Forms 1040 and 8812, page 1, appear below, using MFJ filing status.

What course of action should the Stanleys consider (and take quickly)?

- Change to MFS filing status by filing superseding returns.

- Determine which spouse should claim the children.

Assuming the original return used MFJ filing status and the April 18 due date passes with no superseding return, they are stuck with the lesser child tax credit and no recovery rebate credit. However, if they file superseding returns on or before April 18, they can change their filing statuses to MFS and enhance both credits.

The parent with less income, Mary in this example, claims both children to receive the full child tax credit, or $6,600. If the married couple agrees on this, the tie-breaker rule for claiming children does not come into play. Even though Mary has less income, she and Maxwell are free to let her claim the children.

Preparing Superseding Tax Returns

It is necessary to prepare two superseding tax returns. Each is similar to an amended return in that it’s filed after an original return. Also, each superseding return should include Form 1040-X.

But the IRS treats them differently from the typical Forms 1040-X it receives after the original due date. Generally speaking, the IRS does not have the option of rejecting superseding returns, as it could reject amended returns. A superseding return takes the place of the originally filed return, even if it changes the couple’s filing status from MFJ to MFS. The language of the regulation states,

“For any taxable year with respect to which a joint return has been filed, separate returns shall not be made by the spouses after the time for filing the return of either has expired.” (Treas. Reg. §1.6013-1(a)(1), emphasis added)

The last phrase leaves the window open for filing an amended return before the due date. The cautionary language in the “Amended return filing status” box of Form 1040-X echoes this point. It says,

“In general, you can’t change your filing status from married filing jointly to married filing separately after the return due date.” [emphasis added]

Once they file their superseding returns, it is as if the originally filed MFJ return never existed.

Each spouse reports their income on their own MFS tax return in the examples below.

In this case, the suggested mechanics of filing a superseding return are not complicated. The main point is filing the superseding return before the original due date. If the IRS treats it as an amended return because the taxpayers filed it after the due date, the IRS will almost certainly reject the change.

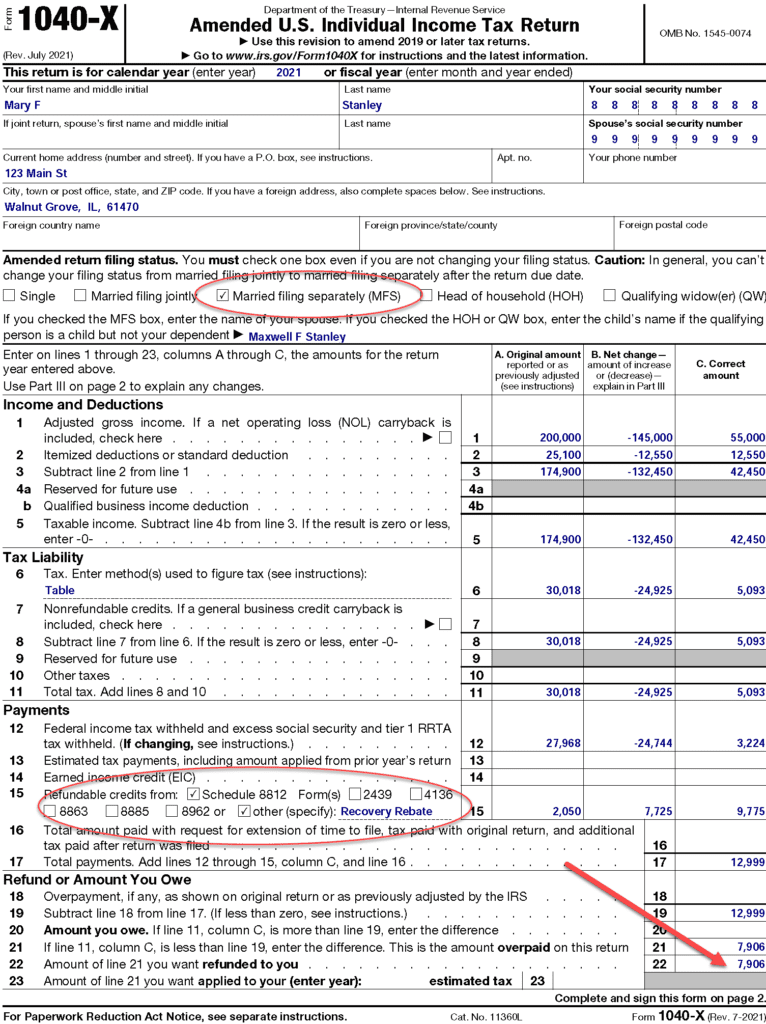

Given the IRS’s backlog in processing paper-filed returns, electronically filing a superseding Form 1040-X is a wise idea. Those preparing superseding returns should consider using the word “superseding” in the Explanation of Changes section of Part III, Form 1040-X. The hypothetical MFS returns for Maxwell and Mary Stanley appear below.

Page 1 of Maxwell’s For 1040-X appears below.

Interesting results emerge from the analysis of these superseding returns

-

- The Stanley’s MFS returns result in a net refund of $5,636 ($7,906 refund on Mary’s MFS return – $2,270 due on Maxwell’s MFS return).

- The Stanley’s total child tax credit increases by $2,500 to the full $6,600 ($3,000 + $3,600). The advance child tax credit payments received must be subtracted from these results.

- Mary also receives the recovery rebate credit of $4,200 ($1,400 x 3) because her income is less than the threshold, and she claims the two children.

- Because Maxwell and Mary agree that she can claim the children, the tie-breaker rule for claiming dependents does not come into play.

- Maxwell’s results include repayment of the advance child tax credit that he received ($1,025).

- Tax practitioners should be alert to how the filing status choice affects other taxes and credits, such as the child and dependent care credit. In the example discussed earlier, Maxwell Stanley’s MFS tax result included some additional Medicare tax.

As of early March 2022, Congress has not extended the increase in the child tax credit beyond 2021. Even though this particular window of opportunity appears to have closed, however, tax practitioners may still discover situations in which married clients benefit from using a filing status other than MFJ.

The Narrow Window Is Closing Soon

Many taxpayers potentially benefit from using MFS filing status on their 2021 tax returns. If those returns have already been filed using MFJ filing status, a superseding return makes a change to MFS possible. However, taxpayers must make this change by no later than April 18, 2022.

Many married taxpayers have not already filed their tax returns. They may benefit significantly if their tax practitioners compare the relative benefits of MFS and MFJ filing status in light of 2021’s unusual tax credits. Most professional tax software makes this comparison straightforward if the income and deductions are attributed to the correct person. Ultimately, it is up to the client to decide how to proceed. The tax practitioner has the responsibility to inform them of options for their consideration.

Other suggestions

When entering data for married couples, tax practitioners should allocate any EIP-3 payments and advance child tax credit payments to each spouse. IRS letters 6419 and 6475 contain these amounts, as do the taxpayers’ online account transcripts.

Some professional tax software makes it easier to optimize the filing status decision if data are entered in a specific way. Designating dependents as joint, rather than designating them for one spouse, may trigger the optimization. In the example cited earlier, entering “J” for joint in the case of both Stanley children could lead the tax practitioner to recommend MFS filing status with Mary Stanley claiming both children. This designation is dependent on the tax software, however.

[1] Amended and Superseding Corporate Returns. Sep. 20, 2021. IRS. [www.irs.gov/businesses/corporations/amended-and-superseding-corporate-returns] Accessed on Mar. 9, 2022. Although this web page specifically addresses corporate returns, the same principles apply to individual returns.

By John W. Richmann, EA, MBA

Tax Materials Specialist, U. of I. Tax School

Disclaimer: The information referenced in Tax School’s blog is accurate at the date of publication. You may contact taxschool@illinois.edu if you have more up-to-date, supported information and we will create an addendum.

University of Illinois Tax School is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information. This blog and the information contained herein does not constitute tax client advice.