Fall Tax School

The essential tax CE that gets you ready for

what’s next in farm, business, and OBBBA-driven tax law.

Practical training, 18 federal tax CPE credits, and the trusted Federal Tax Workbook—everything you need to stay sharp, current, & confident going into tax season.

Reserve your spot today!

Online Fall Tax SchoolWith a variety of half- and full-day options, you can maximize the flexibility of online learning from your home or office. |

|

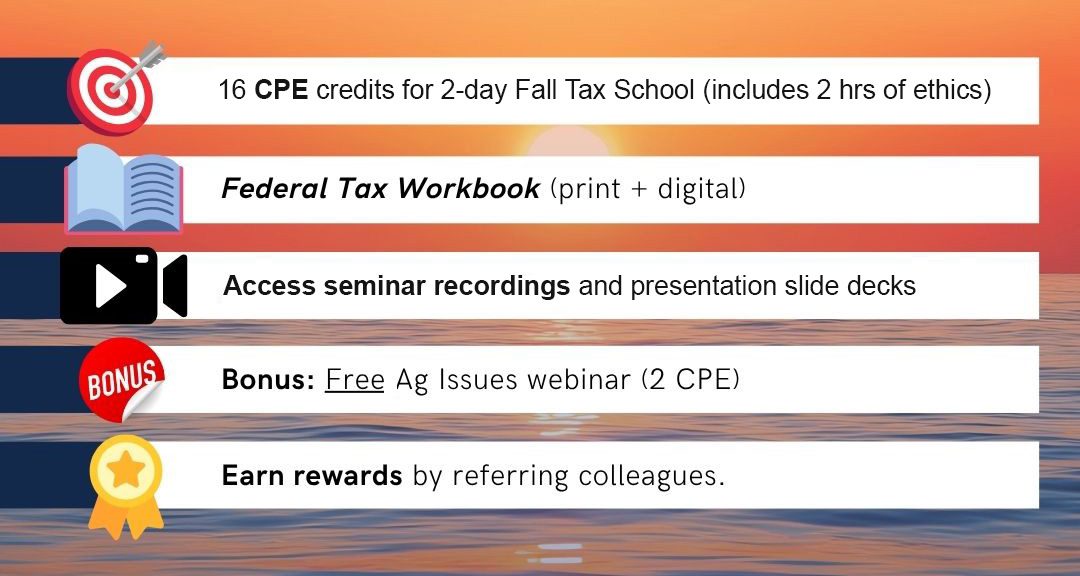

At Fall Tax School, you’ll expand your expertise and earn a whopping 16 federal tax CPE credits, plus you’ll get free access to the Agricultural Issues webinar in December for an additional 2 CPE credits.

Scroll down to learn more about Fall Tax School 2025 and

explore the exciting line-up of topics our instructors will team teach live!.